When people call their insurance agent, it’s rarely good news. A car is totaled. A home is flooded. A loved one has passed away.

That’s what makes insurance customer service fundamentally different from every other industry.

You’re not just managing volume—you’re managing vulnerability. Empathy becomes the only skill that counts when someone’s world is falling apart.

The best insurers understand this. They train their teams to stay calm in crisis and clear in chaos. Because how you respond in that moment shapes everything—loyalty, trust, and even whether they’ll renew their policy next year.

In this guide, we’ll explore why customer service drives real business outcomes in insurance and share seven proven strategies to turn your most stressful interactions into your strongest competitive advantage.

Table of Contents

- What is Insurance Customer Service?

- Why Insurance Customer Service Drives Real Business Outcomes

- 7 Proven Strategies to Improve Insurance Customer Service

- Examples of Insurance Companies Getting Customer Service Right

- Take the First Step to Improve Insurance Customer Service

- Frequently Asked Questions

What is Insurance Customer Service?

Insurance customer service is the support system that insurance companies provide to help policyholders understand their coverage, resolve issues, and navigate the insurance process from purchase through claims resolution.

It covers every interaction where policyholders need help, answers, or reassurance, such as:

- Policy onboarding: Breaking down coverage, exclusions, and terms in plain language so people know exactly what they’re signing up for.

- Billing and renewals: Helping customers navigate payments, spot errors, and understand charges without sending them into a maze of fine print.

- Claims processing: Supporting people through stressful moments like accidents, medical emergencies, or theft—when service matters most.

- Grievance handling: Responding with speed, clarity, and empathy when something goes wrong, making sure no one feels dismissed.

- Post-interaction follow-ups: Keeping customers updated, closing the loop on claims, and reminding them that someone is still looking out for them.

Unlike other industries, insurance customer service is rarely routine. Some customers may go months without calling, but when they do, it’s often during financial transactions, requiring urgent information or even during the hardest moments in their lives.

This is also when customer service in insurance becomes the product itself—not the app, not the policy name, not the marketing campaign. It’s the voice on the other end who picks up, listens, and helps.

Recommended reading

11 Best Practices To Follow For Insurance Customer Service Teams

Why Insurance Customer Service Drives Real Business Outcomes

1. Builds Loyalty in High-Stakes Moments

Insurance sees sporadic use compared to other services. The handful of times that customers do reach out carry more weight than months of silence. These moments are what shape customer retention in this industry.

Google Review about DTRIC insurance and their customer service

When someone calls during a medical emergency and hits an endless IVR loop or gets bounced between agents, that’s a broken promise. Loyalty gets built when you show up quickly, clearly, and calmly during the worst day of someone’s year.

Recommended reading

2. Creates Real Differentiation in a Commoditized Market

Coverage options rarely stand out. The documents look identical, the clauses feel repetitive, and most customers tune out after the second page. What sticks in their memory is how they were treated.

For instance, take healthcare insurance. In a recent survey by Talkdesk, 91% of customers said service quality determines whether they stick with or switch their healthcare insurance provider.

As stats also indicate, service indeed becomes the emotional differentiator that turns “just another insurer” into “someone who gets me.”

3. Reduces Churn Through Friction Removal

When policyholders can update their phone number without sending five emails or renew a plan or policy without chasing reminders, they stay. Easy, respectful, and smooth interactions such as these prevent departures.

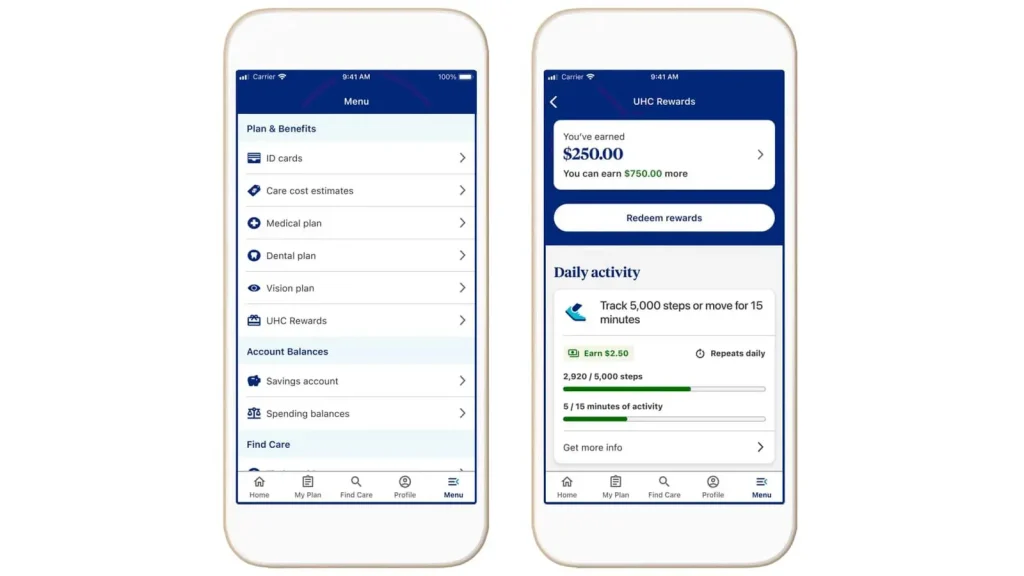

Real-world example: United Health offers a mobile app where members can immediately check their benefits and receive reward points for taking care of their health—removing friction from everyday interactions.

4. Drives Referrals Through Earned Trust

Great service stories travel, even in the insurance field. People share how their claim was settled in hours, how a rep made the billing process painless, or how the app actually worked when they needed it most.

These conversations center on trust, not products. And trust spreads organically through word-of-mouth referrals. Like in this example from Liberty Mutual:

7 Proven Strategies to Improve Insurance Customer Service

1. Prioritize Empathy in High-Stress Moments

Whether it’s a critical surgery, an accident, or a denied claim, customers often feel scared and overwhelmed when they contact support. They need someone who listens, stays calm, understands the issue, and explains options gently and clearly.

Train your agents to validate customer emotions without rushing to problem-solve. Leave every conversation where customers feel heard and supported.

2. Make Policy Details Accessible

Insurance documents rarely make for light reading. Policies get filled with jargon and fine print that leave customers confused about what’s covered, creating distrust toward your company.

Your job? To make that information simpler.

How to implement:

- Create explainer messages in simple language for common queries.

- Build an FAQ section or have a knowledge center where customers can search for answers without calling.

- Add simple explainer videos where agents coach customers through processes like filing claims.

- Keep these resources updated and organized by topics: renewals, coverage, exclusions, premiums, grace periods.

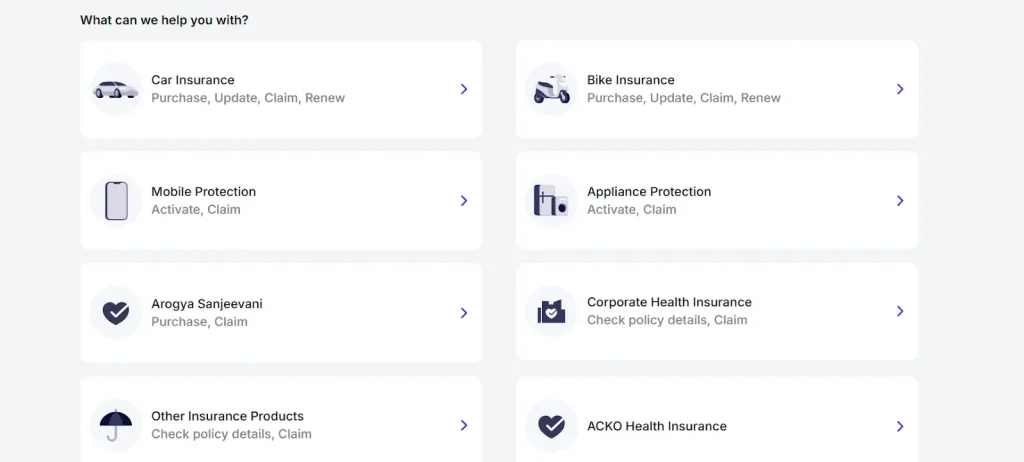

🌟 Real-world example: Acko classifies its FAQs into relevant sections on its website, making it easy for customers to resolve queries quickly without waiting for agent support.

💡Pro tip: With tools like Hiver, you can easily build and manage a knowledge base or FAQ section. It’s searchable, customizable, and serves both your agents and customers, reducing repeat queries and speeding up resolution time.

Hiver’s knowledge base feature which offers support for internal and external documentation

A well-built knowledge base helps customers and employees solve issues independently. This reduces ticket volume and empowers users to get quick answers.

3. Communicate Clearly at Every Step

Providing insurance isn’t like selling a phone or a subscription, where you can walk away after a customer signs up.

There are multiple moments after they sign up when they expect communication from the customer service team about topics from policy onboarding to claim filing, renewals, and premium reminders.

If your messages are delayed, or confusing, it can create panic. Customers might have concerns, such as “Is my claim approved?” “Has my policy expired?” or “Why was I charged with this?”. To avoid that, here are some practices to implement:

- Send proactive, clear, timely updates before customers feel the need to ask.

- Use simple language and visuals where needed..

- Ensure each message includes a point of contact for follow-up questions.

🌟 Real-world example: Employee insurance provider Plum created “PolicyGPT,” where employees can ask questions about their company insurance and get answers in seconds.

4. Simplify Your Claims Process

This is the real test of service quality. When customers need to make a claim, they’re already in distress. If your process is slow and full of back-and-forth communication, you’re not just losing time, you’re losing trust.

The challenge becomes even more complex when you consider the volume and variety of customer inquiries that follow. From initial claim submissions to status updates, and clarification questions, the communication never stops.

Without proper systems in place, these interactions can quickly overwhelm your team and frustrate your customers.

Here are some tips to streamline your claims process:

- Enable easy document submission – Allow customers to upload documents via email, mobile apps, or web portals, giving them flexibility during stressful situations.

- Provide claim tracking – Offer real-time status updates that customers can access independently, reducing the need for status inquiry calls and emails.

- Establish transparent communication protocols – Set clear expectations around timelines, next steps, and required documentation from the very beginning, preventing confusion and repeated follow-ups.

- Eliminate redundant requirements – Audit your paperwork requirements and remove any unnecessary steps that don’t add value to the claims assessment process.

🌟 Real-world example: NFU Mutual earned the highest customer experience rating (CX 77%) and topped claims satisfaction by streamlining their process and maintaining transparent communication.

The reality is that customer queries about claims never stop coming. Many insurance companies struggle to manage this constant flow of communication, as queries arrive through multiple channels, get lost in email threads, or sit unassigned while customers wait for responses. This is where helpdesk solutions like Hiver become invaluable.

With a proper helpdesk software, every customer query gets converted into a trackable ticket, regardless of whether it comes via email, phone, or chat. These tickets can be automatically assigned to the right agents based on claim type or complexity, ensuring nothing slips through the cracks.

Here’s how Hiver can help:

- Shared inboxes that allow your entire claims team to see all customer communications in one place

- Collaborative features like shared drafts that let multiple team members contribute to complex responses

- Internal notes and @mentions that help agents loop in team members and share context without cluttering customer-facing communications

- SLA (Service level agreement) tracking that ensures no claim inquiry goes beyond your promised response time.

With a system like this in place, you transform chaotic communication into an accountable process that keeps both your team and customers informed.

5. Collect and Act on Feedback

Every customer interaction offers a learning opportunity. Are your agents being helpful? Did your claim process frustrate someone? These insights are goldmines for improvement, but only if you actively seek them out.

Don’t wait for angry messages or negative reviews to find out what’s going wrong. By then, you’ve already lost customers and damaged your reputation. Instead, build feedback collection into your standard workflow.

How to implement:

- Deploy automated satisfaction surveys – Set up CSAT or NPS surveys that trigger automatically after key customer moments, such as claim resolutions, policy renewals, or support ticket closures.

- Time your feedback requests strategically – Send surveys when the experience is fresh in customers’ minds, but not so immediately that they feel overwhelmed.

- Make participation effortless – Use simple rating scales or single-question formats that customers can complete in under 30 seconds.

- Create multiple feedback touchpoints – Don’t rely on just one survey type; combine quantitative ratings with optional qualitative comments for deeper insights.

Once you start collecting feedback, the real work begins. Use that data to spot meaningful patterns—identify underperforming departments, learn from top agents, and pinpoint recurring process bottlenecks.

Most importantly, close the feedback loop by acknowledging customer input and following up on negative experiences—this simple step often transforms frustrated customers into loyal advocates.

Recommended reading

6. Ensure Seamless Handoffs Across Departments

Insurance queries rarely stay within one department. A customer asking about a health policy might need input from the medical or claims team. Without careful coordination, this turns into a frustrating loop of “Please hold while I transfer your call.“

That’s why you need systems where different teams can collaborate without losing context.

💡Did you know? Hiver allows you to assign conversations to different departments with full visibility. If someone new joins the conversation, they can see the thread, internal notes, and what’s already been done.

You can also create department-level SLAs to ensure handovers happen quickly and nothing gets stuck between teams.

7. Measure the Right Metrics

Don’t just resort to thinking that your customer service is doing well because complaints are down. In reality, it could mean frustrated customers or worse, quietly switching to competitors instead of complaining.

To attribute your efforts to results, you’ll need to track metrics that matter go beyond surface-level satisfaction. These help uncover the real story of customer loyalty and team performance before it’s too late to act.

Here are some metrics you’ll need to track:

- CSAT (Customer Satisfaction Score): Measures customer satisfaction after specific interactions to identify tone and service quality issues.

- NPS (Net Promoter Score): Tracks long-term customer loyalty and likelihood to recommend your company to others.

- First Response & Resolution Time: Monitors how quickly you acknowledge customers and completely resolve their issues.

- Escalation Rate: Identifies training gaps and process breakdowns when agents can’t handle issues independently.

- Claims Processing Time: Measures speed from initial claim submission to final resolution—critical for customer trust during stressful moments.

- Claims Satisfaction Score: Specific CSAT focused on claims experience, often the most emotionally charged customer interaction.

- Policy Renewal Rate: The ultimate measure of customer satisfaction and service effectiveness over time.

- Average Handle Time (AHT): Balances efficiency with thoroughness to ensure agents resolve issues without rushing customers.

- Self-Service Success Rate: Tracks how often customers can complete tasks independently through self-service channels.

- Retention Rate: Links customer service quality directly to business outcomes and revenue impact.

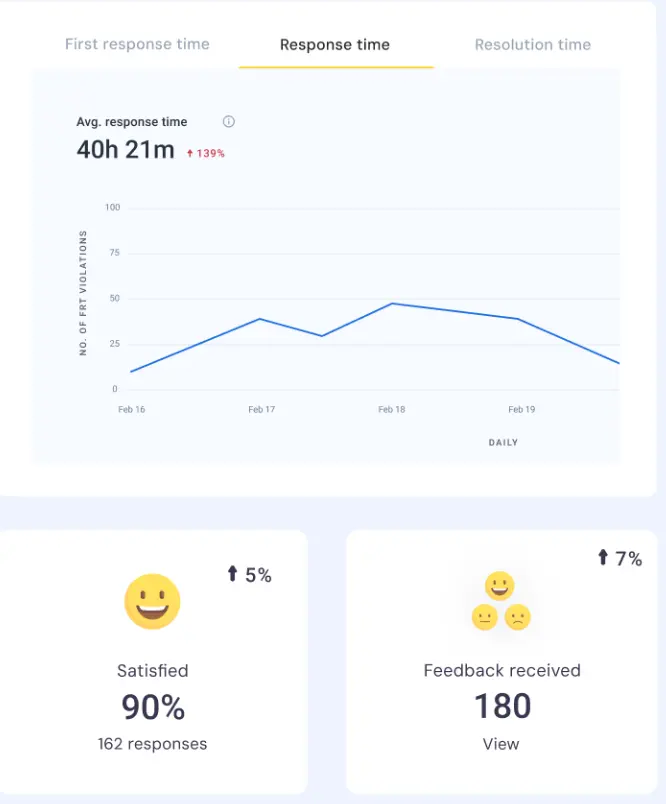

💡Pro tip: With tools like Hiver, you can track all these metrics from one unified dashboard and get real-time CSAT insights to compare team performance across different insurance products or claim types.

Track the right analytics for your customer service with Hiver’s real-time analytics

The platform’s custom reports help you spot patterns—like which agents excel at claims communication or where policy renewal conversations tend to stall.

Features such as SLA tracking ensure no customer query exceeds your promised response times, while detailed analytics turn raw data into actionable improvements for your insurance customer service team.

Examples of Insurance Companies Getting Customer Service Right

While insurance often feels purely transactional, some companies have transformed the customer experience through exceptional service. Let’s examine three standout providers:

1. Lemonade

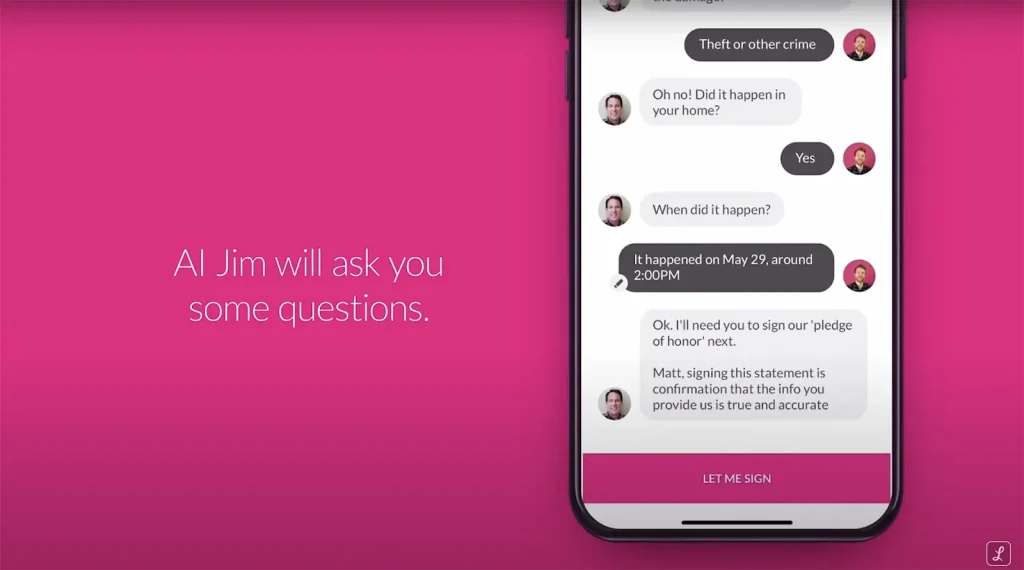

Lemonade is a digital-first insurer using AI to settle claims in minutes and donate unclaimed money to charity. They have an AI-powered claims bot called AI Jim. Jim is surprisingly good at what he does, processing simple claims in as little as 3 minutes. There are no piles of paperwork, and there is no waiting for someone from the claims department to get back from their lunch break.

AI Jim doesn’t just make decisions fast; he makes them fair. Lemonade’s claim model is built on transparency: they take a flat fee, pay claims from a shared pool, and donate leftovers to causes chosen by customers.

Recommended reading

2. State Farm

“Like a good neighbor, State Farm is there“—this slogan has resonated with Americans since 1971 and still holds true today.

State Farm is a legacy insurance giant that still believes in face-to-face support through thousands of local agents. They are huge, but what sets them apart is their network of 19,000+ local agents.

In a world of apps and automated prompts, it’s weirdly comforting to know you can walk into a real office and talk to a human who knows your name and your deductible.

During the recent California fires, State Farm set up a special site where people could walk in for support and claims without any hassles.

3. USAA

USAA has been serving military members and their families for nearly a century, and they’ve built a reputation around speed, fairness, and 24/7 access.

Need to file an auto or property claim at 2 a.m. from a military base? Done. Want to talk to a real person who actually reads your file before transferring you? USAA’s got you. They even assign dedicated claims reps to walk you through the process, start to finish.

Take the First Step to Improve Insurance Customer Service

In insurance, the real product is how you show up when customers need help. Whether it’s a crisis claim or a quick update, every interaction carries emotional weight. That’s your moment to build trust.

When every policy sounds similar and prices are hard to compare, service becomes what customers remember. The top insurance providers won’t be the loudest brands—they’ll be the ones customers talk about because of how they were treated.

If you’re looking to improve your customer service or just handle the influx of claim and policy queries better via a tool, Hiver can be your first step. With built-in shared inboxes, collaboration tools, SLA tracking, and feedback collection, your teams can deliver the empathetic, efficient service that builds lasting loyalty.

Wondering how to get started? Try Hiver for free.

Frequently Asked Questions

What is customer service in insurance?

Customer service in insurance refers to helping policyholders navigate their coverage, answering questions about policies, guiding them through claims, renewals, and endorsements. It ensures customer satisfaction by providing clear information, timely responses, and empathetic support during often stressful situations.

What skills do you need for insurance customer service?

Key skills for insurance customer service include clear communication, active listening, empathy, problem-solving, thorough product knowledge, attention to detail, regulatory awareness, and proficiency with customer management systems. These abilities help deliver accurate information and build trust with clients during vulnerable moments.

What does a customer service representative do in insurance?

An insurance customer service representative handles policy inquiries, assists with claims processing, manages renewals and endorsements, resolves billing issues, and addresses complaints. They maintain accurate records, explain coverage terms, escalate complex cases, and collaborate with underwriters to meet customer needs while providing emotional support during difficult times.

Start using Hiver today

- Collaborate with ease

- Manage high email volume

- Leverage AI for stellar service

Skip to content

Skip to content