Remember when banking meant waiting in line or sitting on hold for 40 minutes? Those days are gone.

Today, if you don’t offer instant, personalized service, your customers will find a bank that does.

That’s why banks are turning to intelligent virtual assistants, such as AI-powered banking chatbots that combine conversational intelligence with secure automation.

These chatbots simplify everyday financial tasks, improve response times, and enhance customer satisfaction and experience.

They’re changing how financial institutions operate and bringing human-like convenience to digital banking.

In this guide, we’ll explore what banking chatbots are and how top banks are using them to deliver faster and more innovative customer experiences.

Table of Contents

- What Is a Banking Chatbot?

- Why Banks Are Turning to Chatbots

- Benefits of Banking Chatbots for Banks and Customers

- Key Use Cases of Banking Chatbots Across Banking Functions

- Real-World Examples of Top Banking Chatbots

- Best Practices for Implementing Banking Chatbots

- Future of Banking Chatbots: What’s Next

- Final Thoughts on Banking Chatbots

- Frequently Asked Questions

TL;DR

| Section | Key Takeaway |

|---|---|

| Definition | A banking chatbot is an AI-powered assistant that helps customers perform everyday banking tasks |

| Why It Matters | Banking chatbots reduce call-center load, cut costs, and offer 24/7 banking support, improving both customer experience and operational efficiency. |

| Key Benefits of Banking Chatbots | They reduce call-center load, offer 24/7 assistance, personalize recommendations, and strengthen fraud prevention. |

| Use Cases | From retail and lending to internal support, banking chatbots simplify processes like onboarding, payments, and customer assistance. |

| Implementation Tips | Start small, connect to core systems, maintain strict data security, and refine the bot using real interactions. |

| Real-World Examples of Banking Chatbots | Leading banking chatbots like Erica, Eno, and digibot highlight how AI is changing digital banking experiences worldwide. |

| Future of Banking Chatbots | Generative AI will enable more natural conversations, voice-enabled banking, and emotion-aware virtual assistants. |

What Is a Banking Chatbot?

A banking chatbot is a software program that helps customers interact with their bank to manage everyday financial tasks. Modern-day chatbots use artificial intelligence techniques like natural language processing (NLP) and machine learning to understand user queries and respond in a natural, conversational language.

Banking chatbot’s core functions include:

- Checking account balances

- Transferring funds between accounts

- Paying utility or credit card bills

- Reporting lost or stolen cards

- Blocking or unblocking cards

- Reviewing recent transactions

They operate via chat, voice, and messaging platforms, offering customers flexible access across their preferred channels.

Why Banks Are Turning to Chatbots

Leading banks have started using banking chatbots to change how they serve customers in a competitive banking landscape. These intelligent AI assistants help with loan application support, assist with fraud alerts and transaction verification, and guide users through KYC and account setup processes.

Here are the key reasons global banking leaders are switching to chatbots in banking:

- Changing customer behavior: Younger, mobile-first users expect instant access to banking through apps or chat. Chatbots powered by conversational AI handle thousands of such requests instantly. 37% of U.S. customers have interacted with a bank’s chatbot in 2022, a number projected to grow significantly in the coming years

- High call-center volumes: Banking chatbots handle repetitive banking requests, reducing pressure on customer service teams.

- 24/7 availability: With AI chatbots operating round the clock, customers can access banking services and customer support anytime, improving customer experience.

- Omnichannel consistency: Chatbots provide omnichannel customer support across websites, mobile apps, and messaging platforms like WhatsApp and Facebook Messenger.

- Personalized assistance: By analyzing customer data, transaction history, and spending patterns, you can deliver tailored financial insights and reminders with chatbots.

- Fraud prevention and compliance: AI chatbots monitor transactions, detect anomalies in cash flow, and help automate KYC or data verification to strengthen security. Banks are already seeing measurable results; American Express has improved fraud detection by 6%, and PayPal has enhanced real-time detection by 10% through AI-powered systems.

- Staying competitive: As fintechs raise expectations for instant, digital-first banking, chatbots help traditional banks remain relevant. They offer 24/7 service, faster query resolution, and personalized customer experiences that match modern user demands.

By using chatbots, banks cut costs, and they change how customers connect with financial services in an always-on, AI-driven world.

Benefits of Banking Chatbots for Banks and Customers

Banking chatbots offer several benefits that help banks improve speed, security, and overall customer service quality. Here’s how they deliver measurable value for both banks and customers:

| Benefit | How It Helps Banks | Customer Impact |

|---|---|---|

| Cost Efficiency | Cuts call-center workload by automating repetitive customer service tasks. | Cost savings allow banks to reinvest in better digital tools and improved customer support. |

| Improved Customer Experience (CSAT) | Delivers accurate information across digital channels using natural language understanding. | Builds trust and improves customer satisfaction through quick responses. |

| Cross-Sell & Up-Sell | Analyzes customer data and transaction history to suggest relevant credit cards or loans. | Personalized offers enhance convenience and loyalty. |

| Feedback Collection | Collects customer feedback and CSAT data for continuous learning. | Customers can easily share feedback to help banks improve their services. |

| Automation & Internal Support | Simplifies internal workflows and helps staff with quick access to policy documents or financial information. | Faster internal service leads to better customer support. |

Key Use Cases of Banking Chatbots Across Banking Functions

Banking chatbots are now part of nearly every core function, from retail operations to compliance and internal support. These AI-powered assistants help banks work faster, communicate clearly, and deliver consistent experiences.

Here’s how banking chatbots are being applied across core functions:

1. Retail Banking

In retail banking, chatbots handle frequent requests such as balance checks, fund transfers, and credit card payments. Quick and accurate responses through apps or websites reduce waiting time and improve everyday banking convenience.

2. Loan Application Support

AI chatbots simplify the loan process by guiding customers through eligibility checks and application tracking. For sales teams, this means faster follow-ups and higher conversion rates with less manual work.

3. Regulatory Compliance

Chatbots play a crucial role in compliance by verifying identities, collecting consent, and maintaining audit trails. Built-in adherence to standards like GDPR and PSD2 ensures data security and reduces manual effort.

4. Customer Service

For customer support, chatbots serve as a reliable first point of contact. Routine questions about transactions, fees, or cards get resolved instantly. With 24/7 availability, you can ensure customers receive help whenever they need it.

5. Personalized Financial Advice

AI-driven assistants turn customer data into actionable insights. Spending habits, savings goals, and investment behavior are analyzed to deliver tailored advice, timely reminders, and personalized product suggestions.

6. Assistance for Banking Personnel

Chatbots also improve internal operations by helping staff retrieve policy details, log IT tickets, and access shared resources. Faster information access keeps teams efficient and ensures smoother collaboration.

Real-World Examples of Top Banking Chatbots

Here’s how leading institutions are setting the standard with their banking virtual assistants:

| Bank / Platform | Chatbot Name | Core Focus | Standout Capability |

|---|---|---|---|

| Bank of America | Erica | Customer banking & insights | 2B+ interactions; personalized financial advice |

| Capital One | Eno | Alerts & fraud detection | Real-time notifications for unusual transactions |

| DBS Bank | digibot | Multilingual customer support | Operates in English, Mandarin & Bahasa Indonesia |

| Commonwealth Bank of Australia | Ceba | Customer banking support | Automates 200+ tasks; understands 60K+ query variations |

| Royal Bank of Canada (RBC) | NOMI | Personalized financial insights | Automates budgeting, cash-flow forecasting, and savings suggestions |

Let’s take a slightly deeper look at these chatbots:

1. Bank of America: Erica

Launched in 2018, Erica combines voice and text-based assistance to help customers check balances, review transactions, and get actionable financial insights. Erica also helps users monitor subscriptions, flag unusual charges, and manage credit usage.

Key Advantage: Handles 2 billion+ interactions with precision and human-like tone.

2. Capital One: Eno

Eno proactively scans customer accounts and sends intelligent alerts via text or app. It flags duplicate charges, subscription renewals, and unusual activity. Eno’s omnichannel design works seamlessly across email, browsers, mobile, and smart devices.

Key Advantage: Generates secure virtual card numbers and detects unusual or duplicate transactions instantly.

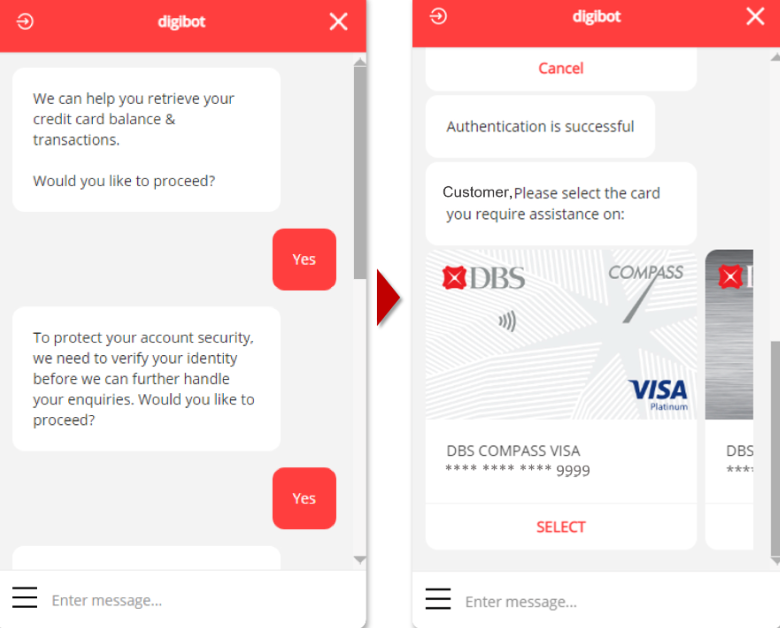

3. DBS: Digibot

Singapore-based DBS Bank launched Digibot to help customers manage accounts and access credit card details across multiple languages. Integrated directly into the bank’s app and website, digibot ensures 24/7 availability while serving a diverse customer base efficiently.

Key Advantage: 24/7 virtual assistance with digibot

4. Commonwealth Bank of Australia: Ceba

Ceba is the Commonwealth Bank of Australia’s AI chatbot that assists customers with everyday banking tasks. It understands over 60,000 natural language variations of customer queries, allowing it to manage around 60% of incoming requests without human involvement.

Key Advantage: Automates 200+ tasks while understanding thousands of customer intents.

5. Royal Bank of Canada (RBC): NOMI

NOMI, integrated within the RBC Mobile app, offers personalized financial insights through predictive analytics. Its features help users track spending and identify savings opportunities. NOMI Insights has delivered over 2 billion personalized insights.

Key Advantage: Uses AI to automate budgeting, cash-flow forecasting, and savings suggestions.

Also Worth Noting: How Hiver Helped Continental Stock Transfer Modernize Financial Support

Continental Stock Transfer & Trust Company (CSTT) uses Hiver to simplify investor communication and ensure service excellence. With automated email routing, SLA tracking, and standardized response templates, CSTT improved response efficiency by 50% and achieved 99% SLA compliance.

Designed for secure, high-volume support environments, Hiver Chatbots help financial teams manage client conversations directly from Gmail. With AI-suggested replies, instant summaries, and enterprise-grade security, Hiver enables faster collaboration, stronger compliance, and consistent service.

As you can see, leading banks are now developing their own chatbots to deliver faster and more intelligent customer service. If you’re curious about how to build a chatbot, our step-by-step guide breaks down how to create a chatbot from design to deployment.

Best Practices for Implementing Banking Chatbots

Banks worldwide are adopting chatbots to deliver faster customer support. Despite differences in design and purpose, the most effective implementations follow a common set of best practices that make them secure, reliable, and easy to scale.

Let’s take a look at them.

1. Strategic Planning and Goal Setting

Define clear objectives before implementation. Identify high-impact use cases like account balance inquiries, branch-hour queries, or proactive payment reminders.

Example: A bank that deploys a chatbot for FAQs can later expand it to manage account servicing and lead qualification.

2. Start Small with High-Volume, Low-Risk Queries

Automate simple, frequent requests like checking balances or resetting passwords. This helps the chatbot learn customer intent safely before handling advanced cases.

Example: A chatbot that first answers “What’s my account balance?” can later process credit card payments or EMI reminders.

3. Integrate with Core Banking and CRM Systems

Seamless integration ensures real-time data access and accurate responses. Connecting with CRM and KYC systems allows customers to complete tasks like retrieving statements within the chat.

Example: When a user asks about a pending loan, the chatbot fetches live data instantly.

4. Design for Human-Centered Experiences

Create intuitive, conversational flows powered by NLP and NLU. Include clear fallbacks and effortless human handoffs for complex issues.

Example: If a customer says, “I’m locked out,” the chatbot guides recovery or routes them to an agent with context.

5. Monitor, Measure, and Optimize Continuously

Measure KPIs such as CSAT and containment rate to refine chatbot accuracy and experience. Use analytics to retrain models regularly based on real customer conversations.

Example: If fallback rates rise for EMI queries, retraining with real data improves precision.

Do not forget to check

⚠️Security and Compliance in Banking Chatbots

AI chatbots in banking handle sensitive customer data and must adhere to strict standards like PSD2, GDPR, PCI DSS, and SOC 2. Regular audits, encryption, and restricted access ensure data protection and regulatory alignment.

For example, if a suspicious login activity is detected, the chatbot encrypts the session and alerts both the customer and the compliance team.

Hiver follows the same principle of security by design. Every AI feature is built with enterprise-grade encryption, zero data retention, and strict access controls.

Customer data is never used to train models, and all AI systems align with global privacy frameworks such as GDPR, SOC 2, and HIPAA, ensuring complete compliance and trust at every step.

Future of Banking Chatbots: What’s Next

AI chatbots are evolving beyond basic customer support to handle complex banking functions, such as loan processing, product guidance, and financial advice. By 2026, 35% of U.S. adults are expected to use AI-powered banking assistants.

As banks continue to invest in AI, several emerging trends are shaping the next generation of banking chatbots. Here are a few:

Generative AI for Personalized Financial Insights

Banks are using generative AI to offer hyper-personalized financial recommendations at scale. Generative AI is expected to add $200–$340 billion in annual value to global banking through more intelligent automation and hyper-personalized financial insights.

Voice-Enabled Bots (ATMs and IVRs)

Voice assistants are making banking more conversational. Banks like Santander are testing voice-interactive ATMs in the US to improve accessibility for visually impaired users.

Multilingual and Emotion-Aware Chatbots

Next-gen chatbots will understand language, tone, and emotion to deliver empathetic support. 48% of global banks now utilize multilingual bots across 23+ languages, and 69% analyze customer sentiment in real-time. Emotion-aware chatbots help de-escalate major issues while maintaining a human-like experience.

AI Copilots Supporting Human Agents

AI copilots are becoming standard in banking operations, assisting agents with instant data retrieval and customer insights. Over 90% of Bank of America employees use an AI-powered virtual assistant to boost productivity and enhance client service. Similarly, Hiver’s AI Copilot enables banking support teams to resolve customer queries faster, summarize conversations instantly, and deliver accurate responses.

Final Thoughts on Banking Chatbots

Banking chatbots have become essential to how leading banks deliver customer service. By automating repetitive tasks and assisting customers in real time, chatbots enable banks to scale service quality while maintaining efficiency and trust.

As conversational AI continues to evolve, banks that adopt AI-driven banking chatbots are already setting new standards in customer service quality.

Investing early means staying ahead of customer expectations and strengthening your brand in a rapidly evolving competitive market.

Don’t get left behind. Explore how Hiver Chatbots can help your team automate banking conversations securely and deliver instant, human-like support.

Frequently Asked Questions

1. What is a chatbot in banking?

A chatbot in banking is an AI-powered virtual assistant that helps customers manage everyday financial tasks through chat or voice. It uses natural language processing (NLP) to understand queries and respond instantly across apps.

2. How do banking chatbots ensure data security?

Banking chatbots protect customer data through encryption, authentication, and secure APIs. They also comply with major financial regulations such as GDPR, PCI DSS, and PSD2 to safeguard sensitive banking information.

3. Are banking chatbots replacing human agents?

No. Chatbots handle routine customer service requests, while human agents focus on more complex or emotionally charged issues. Together, they create a more efficient and responsive customer support system.

4. How can a bank implement a chatbot successfully?

Banks can start by defining clear goals and automating simple, high-volume tasks like balance checks or transaction updates. Successful implementation depends on selecting a secure, AI-powered platform and integrating it with core banking and CRM systems.

5. What are the challenges of using chatbots in banking?

Key challenges of using chatbots in banking include ensuring data privacy, maintaining compliance, and training the AI to handle diverse customer intents.

Skip to content

Skip to content