How is AI reshaping AP and AR?

AI automation can take over repetitive tasks, reduce human error, and find valuable insights from large amounts of data. This results in smoother workflows, better cash flow management, and smarter financial decisions.

In fact, as per our “AI vs Human: The Future of Customer Support” report, about 50% customer support professionals believe AI and humans will collaborate over the next five years.

Finance teams are already seeing the impact of AI in day-to-day operations—from invoice processing to fraud detection. So, in this article, we’ll explore how AI can improve AP and AR and look at some tools that help streamline these processes.

Table of Contents

- How is AI reshaping AP and AR?

- Quick summary

- Why trust us?

- What is AI in accounts payable and accounts receivable?

- Current challenges in accounts payable and receivable

- How can AI streamline accounts payable operations

- How can AI streamline accounts receivable operations

- Top 6 accounts payable and receivable tools for businesses

- Benefits of artificial intelligence in accounts receivable and payable

- AI’s role in AP and AR reporting and analytics

- Best practices to implement AI in AP and AR

- Barriers to implementing AI in accounts payable and accounts receivable

- Where AP automation stands today

- Future trends in AI for streamlining AP and AR operations

- AI in action: Real-world use cases

- How Hiver helps across industries

- Conclusion

Quick summary

Manual invoice handling and slow payment cycles drain time, create errors, and hold finance teams back. This guide breaks down six leading AP and AR automation tools, including Hiver, Tipalti, and HighRadius, that streamline approvals and accelerate collections. You’ll also get a clear view of the top AI use cases, analytics capabilities, and automation trends reshaping modern finance operations.

Why trust us?

We evaluated all six tools using clear criteria – usability, features, integrations, reliability, and support – so you get recommendations grounded in real testing, and not guesswork. With 10,000+ teams using Hiver, we understand what dependable software actually looks like in everyday finance operations, especially when adopting AI in accounts payable and receivable. Our AI-driven workflows are used globally to streamline approvals, reduce manual effort, and prevent payment delays.

What is AI in accounts payable and accounts receivable?

AI in Accounts Payable (AP) and Accounts Receivable (AR) means you spend less time on manual payment tasks and more time on work that moves the business forward. It takes the busywork out of paying suppliers and collecting from customers.

Here’s what it means in each context:

AI in accounts payable (AP)

AI automates invoice processing, approvals, and payments. Teams spend less time on data entry and fixing errors, and more time on strategy.

Key applications include:

- Invoice data extraction: AI reads invoices automatically and pulls out key details like vendor, amount, and due date—no more manual typing.

- Fraud detection: AI spots duplicate, suspicious, or mismatched invoices before they become a problem.

- Approval workflows: AI gets invoices to the right approver quickly, based on simple rules or what’s worked in the past.

- Cash flow forecasting: AI predicts what’s coming up, so you can plan payments and avoid surprises.

- Supplier insights: AI reviews vendor performance and payment trends, giving you leverage in negotiations and helping spot issues early.

AI in accounts receivable (AR)

In AR, AI helps teams collect cash faster, spot late payments before they happen, and manage credit with less risk and hassle.

Key applications include:

- Payment prediction: AI flags customers who might pay late, so you can follow up before it slows you down.

- Automated reminders: AI sends payment reminders on time and tailors them for each customer, so nothing slips through the cracks.

- Cash application automation: AI matches payments to invoices automatically, cutting down on errors and manual tracking.

- Dispute resolution: AI gets disputes to the right person quickly, so you can resolve issues faster and avoid bottlenecks.

- Credit risk assessment: AI reviews payment history and customer data to help you set smarter credit limits and avoid surprises.

Current challenges in accounts payable and receivable

Managing AP and AR manually brings several challenges, such as:

| Pain point | Description | Example |

|---|---|---|

| Manual workflows and inefficiencies | Tedious data entry and processing prone to errors and delays, Involves multiple handoffs between departments. | A typo in an invoice amount causes a $10,000 overpayment, which takes two weeks to resolve and disrupts cash flow. |

| Slow processing times | Delays in invoice approval and payment collection, straining supplier relationships and affecting cash flow. | An invoice sits in an approval queue for a week, resulting in a supply hold and financial loss due to a key manager being on vacation. |

| Fraud risks and compliance issues | Difficulty in detecting fraudulent activities and ensuring compliance with regulations due to manual processes. | An employee approves fake invoices for months, causing financial losses and damaging the company’s reputation with investors. |

| Lack of visibility | Limited real-time visibility into cash flow, hindering decision-making and strategic planning. | A company struggles to track outstanding payments and misses key insights into cash flow trends, which affects its ability to plan and allocate resources effectively. |

| High operational costs | Increased costs due to labor-intensive processes and the need for additional staff to manage manual tasks. | A business hires extra personnel to handle the high volume of invoices, leading to increased operational expenses without corresponding improvements in efficiency. |

| Inconsistent payment terms | Difficulty in managing and enforcing consistent payment terms with suppliers and customers, leading to cash flow issues. | A company faces challenges maintaining consistent payment terms, which resulted in disputes with suppliers and delays in receiving payments from customers. |

How can AI streamline accounts payable operations

Accounts Payable (AP) is a vital component of any business, ensuring suppliers and vendors are paid accurately and on time. Here’s how AI can streamline this process:

- Intelligent approval workflows: AI streamlines the traditional invoice approval process by automating the workflow, routing invoices to the appropriate approvers based on predefined rules and priorities. With Hiver, for instance, you can automate email workflows to get approvals on time and keep approval logs. Set up approval processes and add invoices to your ERP directly from your inbox.

- Fraud detection: AI detects fraud by analyzing transaction patterns and identifying anomalies that may indicate suspicious behavior. For example, if there is an unexpected spike in invoice amounts or payments to unfamiliar vendors, AI can flag these for further investigation.

- Smart invoice processing: Instead of manually inputting invoice details, AI can swiftly and accurately extract information such as invoice numbers, dates, amounts, and vendor details – with the help of AI-powered Optical Character Recognition (OCR) and machine learning algorithms.

- Supplier relationship management: AI tools optimize payment schedules by analyzing past payment behaviors and cash flow trends. For instance, AI can suggest the best times to make payments to take advantage of discounts or avoid late fees, strengthening supplier relationships.

How can AI streamline accounts receivable operations

Managing accounts receivable can be complex and time-consuming, with challenges such as manual invoice generation, tracking payments, and handling disputes with customers. AI can significantly streamline AR operations by automating these processes.

- Automated invoice generation and delivery: AI systems generate invoices based on transaction data, ensuring consistency and accuracy. For example, AI can automatically generate invoices at the end of each month, include all relevant transaction details, and send them to customers via email.

- Payment tracking and reconciliation: Tracking incoming payments and reconciling them with outstanding invoices can be a labor-intensive task. AI simplifies this process by automatically matching payments to invoices, identifying discrepancies, and updating records in real-time.

- Predictive analytics for payment behavior: By examining patterns and trends, AI systems forecast which customers are likely to pay late and which might default. This predictive capability allows businesses to take proactive measures, such as sending early payment reminders to at-risk customers or adjusting credit terms.

- Intelligent dunning strategies: AI improves traditional dunning strategies by personalizing communication based on customer behavior. It segments customers by payment history and tailors messages, sending gentle reminders to occasional late-payers and firmer notices to customers who frequently miss payment deadlines.

Top 6 accounts payable and receivable tools for businesses

Here are six tools and their key features that help streamline accounts receivable and payable operations:

1. Hiver

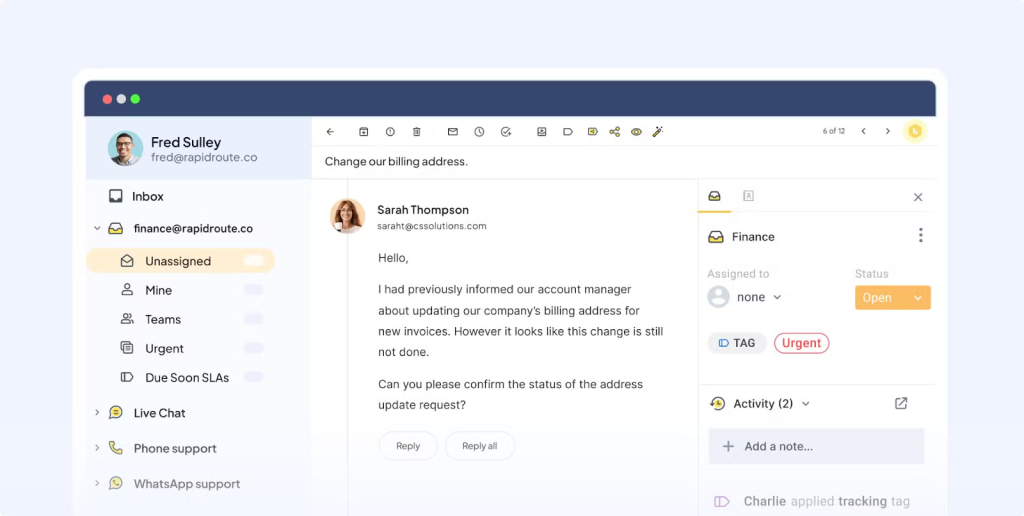

Hiver is a modern AI-powered customer support platform. It brings email, chat, voice, and internal collaboration into one simple interface—so AP, AR, accounting, and payroll teams can work faster without juggling tools.

At its core is a smart AI engine that automates repetitive work, understands context, and supports your team across the entire support lifecycle. While Hiver AI handles routine tasks in the background, your finance team stays focused on strategic decisions, vendor relationships, and cash flow.

Key features:

- Clear ownership for every email: Distribution lists often cause confusion and delays. With Hiver, every AP or AR email gets an owner, status, and timeline. For example, an invoice discrepancy sent to payables@ is instantly assigned to the right analyst instead of sitting unnoticed in a shared inbox.

- Manage customer and vendor queries: Vendor invoices, disputes, statements, and payment reminders stay organized and trackable. A carrier asking for a payment status or a vendor following up on a missing remittance gets routed and resolved without clutter or missed threads.

- Collaborate seamlessly: Internal Notes and @mentions help teams align quickly. If an invoice needs approval from finance ops or input from procurement, the team loops them in directly on the email. No Slack threads or forwarded chains.

- Automate the busy work: With powerful automations, vendor questions get auto-routed to the right agent, expense receipts are classified instantly, and common replies (like W-9 requests or payment timelines) are generated automatically.

- Make decisions with data-driven insights: Hiver shows email volume, request types, turnaround times, backlog health, and workload. If month-end traffic spikes or payment follow-ups start slowing down, leaders can identify bottlenecks and rebalance workloads instantly.

- Fast-track approvals and resolutions: Structured workflows move invoices and exceptions through the right approvers quickly. A knowledge base helps deflect routine queries—like “What’s our payment cycle?” or “How do I submit expenses?”—reducing back-and-forth and speeding up resolutions.

2. Tipalti

Tipalti offers a comprehensive solution that automates the entire AP process, from invoice capture to payment reconciliation. Its AI capabilities streamline workflows, ensure compliance, and enhance financial control.

Key features:

- Automated invoice capture: Uses AI to recognize and extract data from invoices, reducing manual data entry.

- Intelligent approval routing: Automates the approval process by routing invoices based on amount, vendor, and other criteria.

- Payment reconciliation: Matches payments with invoices automatically, ensuring accurate and timely record-keeping.

3. HighRadius

HighRadius leverages AI to optimize AR processes, focusing on credit risk assessment, collections, and dispute management. It helps businesses improve cash flow and reduce the risk of bad debt.

Key features:

- Credit risk assessment: Uses AI to analyze customer data and predict credit risk, enabling informed decision-making.

- Automated collections: Personalizes collection strategies based on customer behavior and payment history.

- Dispute management: AI-driven workflows streamline the resolution of payment disputes, reducing the manual time and effort required for follow ups.

Recommended reading

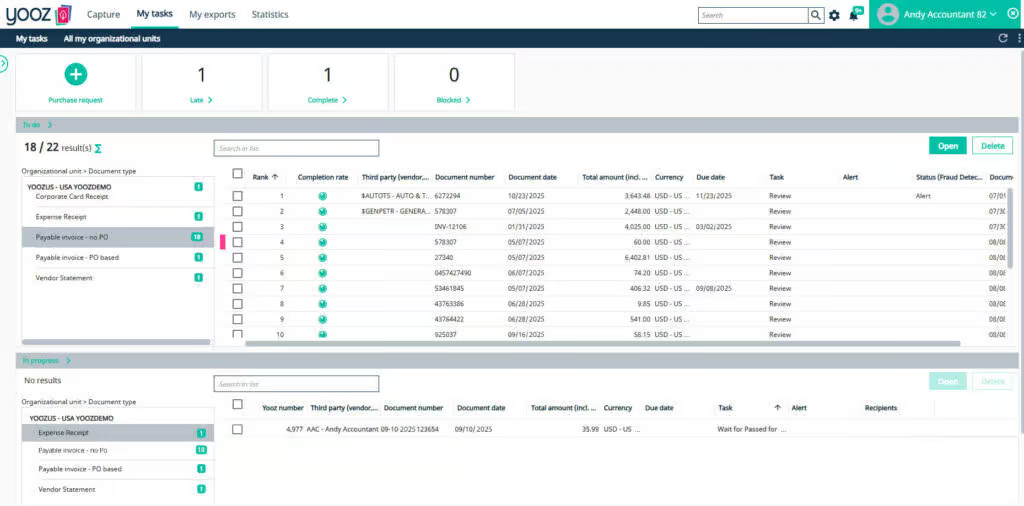

4. Yooz

Yooz specializes in automating AP workflows and ensuring compliance. Its AI-driven platform captures, processes, and approves invoices efficiently, enhancing accuracy and control.

Key features:

- AI invoice capture: Automates data extraction from invoices using AI, reducing manual entry and errors.

- Workflow automation: Intelligent routing of invoices for approval based on customizable rules.

- Compliance assurance: Ensures all invoices meet regulatory and company standards, reducing compliance risks.

5. Versapay

Versapay is an AR automation platform that simplifies invoicing, payment processing, and cash application. It promotes real-time data sharing between teams and customers to speed up collections.

Key features:

- Online payments: Provides a seamless online payment system.

- Omni-channel invoicing: Supports multiple invoicing channels.

- Cash application: Automatically matches invoice numbers with payments, reducing manual effort.

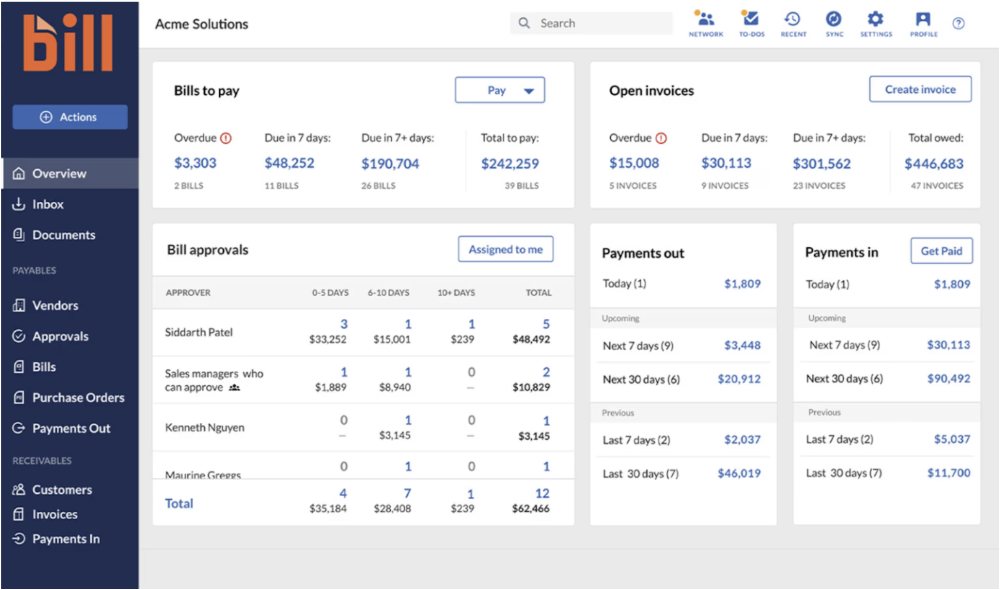

6. BILL

BILL is an AP automation platform that simplifies and streamlines the entire accounts payable process. It uses AI to automate various tasks, from invoice capture to payment processing, enhancing efficiency and accuracy.

Key features:

- AI-powered invoice capture: Automatically extracts and processes invoice data, reducing the need for manual data entry and minimizing errors.

- Automated approval workflows: Routes invoices to the appropriate approvers based on predefined rules, speeding up the approval process and reducing bottlenecks.

- Payment scheduling: AI helps optimize payment schedules, ensuring timely payments to suppliers while managing cash flow effectively.

Recommended reading

Benefits of artificial intelligence in accounts receivable and payable

Here are some benefits:

- Efficiency and accuracy: AI handles repetitive tasks like data entry, invoice processing, and payment tracking, leading to fewer errors and faster operations.

- Cost savings: Using AI leads to significant cost savings as it helps cut down on errors, speed up processes, and optimize workflows. These improvements mean lower labor costs, fewer expenses correcting mistakes, and overall more efficient operations.

- Better cash flow management: AI improves cash flow management by accelerating invoice processing and payment collection. Automating these processes ensures timely customer payments and helps avoid late fees to suppliers. This leads to a more stable cash flow, enabling the business to operate smoothly and plan for the future without financial disruptions.

- Informed decision-making: AI provides valuable insights by analyzing patterns and trends in financial data. It can predict future financial scenarios and suggest optimization strategies. For instance, a tech startup can use AI to analyze its accounts receivable data. It can find out which customers are likely to delay payments and use this information to follow-up proactively or offer early payment discounts.

AI’s role in AP and AR reporting and analytics

AI isn’t just for processing invoices anymore. It’s also the backbone of modern AP and AR. Now, it interprets your data in real time to guide smarter decisions.

In AP, AI tracks invoices, approvals, and vendor performance. It spots patterns, like approval bottlenecks or slow suppliers, that used to take weeks to notice. These insights help leaders plan cash and tune AP workflows.

In AR, AI reviews payment patterns to predict DSO, flag likely late payers, and alert teams before issues hit cash flow. What used to take hours or days now happens in seconds, giving CFOs a clearer view of working capital.

Here’s how AI makes AP and AR analytics more useful:

- Real-time visibility: Dashboards show invoice status, exceptions, and payment timelines at a glance.

- Predictive insights: AI forecasts what’s coming in and going out, so you can plan ahead with confidence.

- Anomaly detection: Continuous monitoring catches errors or odd spending patterns right away.

- Actionable intelligence: AI suggests next steps, like adjusting payment priorities or flagging supplier risks, so nothing gets missed.

Best practices to implement AI in AP and AR

Implementing AI in AP and AR requires careful consideration of integration challenges, data privacy, and security, as well as effective change management strategies. Here are some best practices:

- Assessment and planning: Conduct a thorough assessment of existing systems and identify integration points. Develop a detailed implementation plan that outlines steps, timelines, and responsibilities.

- Pilot testing: Start with a pilot project to test the integration on a smaller scale. This helps identify potential issues and allows for adjustments before a full-scale rollout.

- Stakeholder engagement: Involve key stakeholders from the beginning of the project. Communicate the benefits of AI and address any concerns to gain their support.

- API utilization: Use Application Programming Interfaces (APIs) along with an API management gateway to facilitate seamless communication between AI tools and existing systems. APIs can simplify the integration process and enhance compatibility.

- Vendor collaboration: Work closely with AI vendors to ensure their tools are customized to fit your specific needs and existing infrastructure.

- Compliance with regulations: Ensure that AI tools comply with relevant data protection regulations such as GDPR, CCPA, and industry-specific standards.

- Access controls: Establish strict access controls to limit who can access financial data. Use multi-factor authentication and role-based access controls to enhance security.

- Regular audits: Conduct regular security audits and vulnerability assessments to identify and address potential security risks.

- Comprehensive training: Provide thorough training programs for all users. Ensure they understand how to use AI tools and are aware of the new workflows.

No extensive training required. Finance teams can get started with Hiver in minutes.

Barriers to implementing AI in accounts payable and accounts receivable

AI brings clear benefits to AP and AR, but most teams still hit hurdles when it’s time to implement. The challenges aren’t just technical. They’re about data, processes, and how ready your people are to change.

1. Data fragmentation

A lot of companies use multiple ERPs and payment tools that don’t talk to each other. When data is scattered, AI can’t give you a full picture, and automation gets inconsistent results.

2. Poor data quality

AI needs clean, structured data to spot patterns. If invoice formats are all over the place or details are missing, you’ll get unreliable insights or miss red flags.

3. Resistance to change

Finance pros used to manual reviews and spreadsheets may be slow to trust automation. Worries about job changes or confusion about AI’s role can slow things down.

4. Cost and skill constraints

Advanced AP automation tools can require upfront investment, and smaller teams often don’t have in-house AI expertise to keep things running smoothly.

How teams get past these barriers:

- Start small; automate invoice capture, approval routing, and anomaly alerts first.

- Clean up your data before you roll out automation.

- Pick systems that are easy to use and work with the tools you already have.

Where AP automation stands today

AP automation is a CFO priority. Cloud systems and built-in AI are now standard for modern finance teams, and their adoption keeps rising.

The AP automation market could hit $1.47 billion by 2025, growing 14% a year. But fewer than half of organizations have even partially automated, and less than 10% have true end-to-end automation.

The leaders are already seeing the upside:

- Almost half of all invoices are processed without any human touch.

- Approval cycles now take about three days.

- Processing costs are down to $3 per invoice, less than half of what manual work costs.

But there are still roadblocks. Manual exception handling, disconnected systems, and messy data slow teams down. A lot of companies still haven’t adopted supplier e-invoicing, and many aren’t using AI features like fraud detection at all.

Today, finance leaders are moving to unified automated AP workflows, which is one system for capturing, approving, and paying invoices. This approach is quickly becoming the new standard for speed, accuracy, and cash flow visibility.

Future trends in AI for streamlining AP and AR operations

Here are some popular trends:

1. Predictive Analytics: Predictive analytics uses AI to analyze historical data and forecast future trends, enhancing decision-making in financial operations. In AP and AR, it can:

- Analyze past payment behaviors to identify customers likely to pay late and suggest proactive measures like sending reminders or adjusting credit terms.

- Help businesses maintain healthier cash flow and reduce the risk of bad debt by predicting payment delays.

- Provide insights into spending patterns, aiding in budget optimization and financial planning.

2. Hyper Automation: Combine AI with technologies like Robotic Process Automation (RPA) to automate entire processes. For AP and AR, AI handles tasks such as data extraction from invoices, while RPA takes over repetitive tasks like data entry, email responses, and workflow management.

Prediction: Hyper Automation will lead to seamless automation, reducing the need for human intervention and greatly increasing efficiency. An automated AP process could have AI extract invoice data, RPA enter this data into the ERP system, and then AI verify the accuracy and route it for approval.

3. Blockchain integration: Blockchain technology offers a secure and transparent way to handle transactions. Integrating blockchain with AI enhances the security and transparency of financial transactions, ensuring all actions are traceable and verifiable.

Use case: In AP, blockchain can create a transparent ledger of all transactions, while AI ensures the data entered is accurate and complete. This integration prevents fraud and errors since every transaction is recorded on a secure, immutable ledger. Similarly, in AR, blockchain can maintain a transparent record of all customer payments, boosting trust and accountability.

AI in action: Real-world use cases

You can see the results of AI in AP and AR every day. Automating approvals, predicting payments, and reducing errors helps finance teams work smarter and make better calls.

Here are some of the most common and useful AI use cases in AP and AR today:

1. Invoice processing without the busywork

AI pulls data from invoices, checks entries, and matches them to POs automatically. This means no more manual typing or cross-checking. It also:

- Cuts out manual entry errors.

- Speeds up approvals and lowers costs.

- Sets you up for touchless AP automation.

2. Smarter payment forecasting

AI looks at past payment data to predict when suppliers get paid, and when your customers are likely to pay you. It also:

- Improves cash-flow visibility.

- Helps you plan working capital more accurately.

3. Fraud detection and compliance alerts

AI keeps an eye on invoices and payments to flag duplicates, oddities, or possible fraud before money changes hands. It also:

- Protects you from overpayments and vendor manipulation.

- Helps you stay compliant and ready for audits.

4. Smarter collections and customer communication

AI sends reminders tailored to each customer and automates follow-ups, so you don’t have to chase payments manually. It also:

- Reduces days sales outstanding (DSO).

- Improves customer relationships by making outreach timely and relevant.

Each of these automated AP workflows turns reactive work into proactive insights, driving efficiency, visibility, and better decisions across finance.

How Hiver helps across industries

Teams across industries use Hiver to streamline finance operations. With shared inboxes such as payables@, finance@, and accounts@, finance teams can manage vendor and customer requests faster, eliminate missed emails, and speed up cash collections.

Unlike traditional helpdesks, Hiver is simple to adopt yet powerful enough for complex finance workflows. The powerful AI engine helps automate repetitive tasks, assists agents in real time, and gives finance leaders clear visibility into what’s pending, blocked, approved, or paid. Here’s how Hiver helps:

1. Logistics companies

Finance and operations teams in logistics deal with high volumes of carrier invoices, rate confirmations, POD requests, and payment follow-ups. Hiver helps them centralize workflows, track every request, and respond without delays.

For instance, the AP/AR team of Arrive Logistics, a technology-driven freight brokerage company, saw measurable improvements after switching to Hiver:

- 40% faster email handling through automated routing

- 658 hours saved every month by removing manual sorting and duplicate responses

- Zero missed emails and significantly fewer repeated replies

- More time unlocked for employees previously stuck with mundane, repetitive work

What made this possible?

- Automated routing for faster processing: Emails from specific carriers are auto-assigned to the right team members using Hiver’s email assignment rules, ensuring nothing slips through.

- Internal collaboration using Notes: The team solves issues collaboratively within Hiver—no forwards, no CCs, no separate tools. Notes alone save the team about 35 minutes every day.

- Analytics that reveal bottlenecks: With Hiver analytics, the team tracks turnaround times, email volume, and workload distribution. This helps them identify delays, reassign tasks when needed, and plan staffing better.

“I love the fact that Hiver is extremely intuitive. If I was looking at Hiver as a person, this person would be very well organized, very process-oriented.” – Christina O’Connor, Manager, Finance at Arrive Logistics

2. Finance companies

Finance teams in fintech handle a constant flow of payment queries, onboarding issues, compliance requests, and transactional escalations. As their volumes grow, traditional shared inboxes simply can’t keep up. This is exactly where Hiver helps finance operations stay structured, fast, and error-free.

Craftgate, a unified payment orchestration platform, manage virtual POS systems, e-money providers, and multiple payment methods from one dashboard. Using Hiver, the team finally gained visibility, accountability, and collaboration, in a familiar workspace.

- 130+ hours saved every month using automation, templates, and internal collaboration

- 700+ conversations auto-assigned each month with zero missed emails

- 35% faster response and resolution times through structured workflows

What made this possible?

- Smart routing keeps every request on track: With Hiver’s round-robin assignment, every new conversation is routed automatically to an available agent. No manual triaging, no overlooked emails, and no confusion over ownership.

- Integrations keep the team aligned: The team uses Hiver’s Slack integration to speed up technical escalations, ensuring engineers and support agents stay synced without constant back-and-forth.

- Templates bring speed and consistency: Hiver’s response templates help the team reply faster while maintaining consistent, high-quality communication.

“We wanted a solution that could handle the complexity of fintech support but still felt easy to use. Hiver gave us automation, visibility, and collaboration—all in the inbox our team already uses daily.” – Lemi Orhan Ergin, Co-founder and Technical Lead, Craftgate

Hiver also supports teams across healthcare, SaaS, travel, hospitality, and several other industries. You can explore more customer stories here.

Conclusion

AI is making a big difference in accounts payable (AP) and accounts receivable (AR) by improving efficiency, accuracy, and decision-making. It handles tasks like smart invoice processing, automated approvals, and predictive analytics. These real-world AI use cases in AP and AR mean your financial operations run smoother, and your business can grow faster.

If you want to stay competitive and improve how you manage finances, it’s time to look into AI solutions. Finding the right tool is key. Hiver is a great option that can help streamline all finance-related communication and approval workflows from an easy-to-use and intuitive platform.

Skip to content

Skip to content