Accounts payable (AP) is a critical function within any business. It’s responsible for managing payments to suppliers and streamlining finance operations. However, traditional AP processes can be manual, time-consuming, and prone to errors, stifling productivity.

Let’s say an employee manually enters an incorrect invoice amount. It could lead to a scenario where you end up overpaying a vendor. This, in turn, results in additional reconciliation efforts, delays in correcting the mistake, and even financial losses.

That’s where accounts payable automation can help. It’s a system that can identify potential discrepancies, flagging them for review before processing the payment.

In this article, we’ll cover the following:

- What is accounts payable automation?

- Benefits of accounts payable automation

- How to implement AP automation

- Comparison of top AP automation software

[cta_block]

Table of Contents

- Key Takeaways

- What is Accounts Payable Automation?

- Top Accounts Payable Tasks to Automate

- How Does Accounts Payable Automation Work

- Benefits of Accounts Payable Automation

- How to Implement Accounts Payable Automation

- Top 10 Accounts Payable Automation Software

- How to Select an Accounts Payable Software

- Automate Accounts Payable Inside Gmail

- Frequently Asked Questions (FAQs)

Key Takeaways

Here are some of the key takeaways that we will delve into:

- Understanding Accounts Payable Automation: Discover how AP automation streamlines the management of financial liabilities.

- Automating Everyday Tasks: Learn to automate routine financial tasks including invoice processing and other repetitive duties.

- Advantages of Automating Accounts Payable: Explore the myriad benefits including improved accuracy, time and cost savings, enhanced transparency, and strategic financial management.

- Implementing Automation: Understand the steps involved in adopting accounts payable automation, from assessment to full integration.

- Exploring Automation Tools: Familiarize yourself with various AP tools like Hiver, Tipalti, BILL, AvidXchange, Spendesk, Xero, and others.

- Choosing the Right Software: Gain insights on selecting the most suitable accounts payable automation software for your business, considering factors like cost, scalability, user-friendliness, and integration capabilities.

Easily Manage Accounts Payable With Hiver

What is Accounts Payable Automation?

Accounts Payable (AP) Automation refers to the systematic use of technologies to replace and enhance the traditional, manual methods involved in the accounts payable process. This process traditionally encompasses the processing, approval, and payment of supplier invoices.

If you’re managing accounts payable manually, it can get super time-consuming. For instance, in a large organization (over 250 employees), handling a single invoice can take days or even weeks. That’s because it might require multiple levels of approval.

That’s where AP automation comes in. It replaces manual and paper-based processes with automated systems to save time and costs.

Did You Know: 60% of AP leaders consider lengthy approval times for invoices a major challenge in accounts payable management.

Top Accounts Payable Tasks to Automate

Automating accounts payable processes can significantly improve efficiency and accuracy in financial operations. Here are the top tasks within accounts payable that are often automated:

- Invoice Processing: Automation helps capture, process, and manage invoices electronically, reducing manual data entry and processing time.

- Three-Way Matching: Automatically cross-verifying purchase orders, receipt of goods, and invoices to ensure accuracy and prevent fraud.

- Payment Processing: Scheduling and making payments electronically, managing payment methods, and ensuring timely transactions.

- Vendor Management: Maintaining vendor information, tracking performance, and managing contracts electronically.

- Tax Compliance: Automating tax calculations and ensuring compliance with various regulations.

- Exception Handling: Identifying discrepancies or anomalies in invoices and routing them for resolution without manual intervention.

- Record Keeping and Archiving: Securely storing and managing documents and transaction records in compliance with retention policies.

How Does Accounts Payable Automation Work

Accounts payable automation streamlines and optimizes the process of managing a company’s outgoing payments. Here’s how it generally works:

- Invoice Receipt: Automation begins as soon as an invoice is received. Traditional paper invoices are scanned, while electronic invoices can be automatically fetched or received via email. Optical Character Recognition (OCR) technology converts different formats of invoices into a standard digital format.

- Data Capture and Validation: The system captures relevant data from the invoice such as vendor details, purchase order number, invoice date, total amount, etc. It then validates this information against predefined rules within the system (like matching purchase orders or contracts).

- Three-Way Matching: In many systems, a three-way match is automated, cross-checking the invoice with the purchase order and the goods receipt note. This ensures that the company pays only for the goods or services correctly ordered and received.

- Approval Workflow: Based on predefined rules, the invoice is routed to the appropriate person or department for approval. Automation ensures that this process is done quickly, with reminders and escalations in place for any delays.

- Payment Processing: Once approved, the payment is scheduled and executed according to the company’s payment policies and the payment terms negotiated with the vendor.

- Exception Handling: Any invoices that do not match or are flagged for any reason are routed to exception handling queues where staff can review and resolve discrepancies.

- Reporting and Analytics: The system provides detailed reports and analytics on the accounts payable process, helping identify bottlenecks, track performance, and find opportunities for further optimization.

Benefits of Accounts Payable Automation

Here are some major advantages of automating accounts payable workflows.

- Time and Cost Savings: It reduces manual effort, processing time, and the costs associated with manual document handling and storage.

- Improved Accuracy and Reduced Errors: This technology minimizes human error through optical character recognition (OCR) technology and intelligent data extraction.

- Enhanced Visibility and Control: Provides real-time insight into the AP process, enabling better tracking, monitoring, and compliance with policies and regulations.

- Faster Processing and Approval Cycles: Electronic workflows and automated matching speed up invoice processing and approvals, reducing bottlenecks.

- Vendor Relationship Management: Improves vendor communication and transparency, leading to stronger relationships and potentially better terms.

- Strategic Insights and Reporting: Facilitates tracking and analysis of key metrics for process improvement and working capital optimization.

- Regulatory Compliance and Audit Readiness: Ensures accurate data capture and record-keeping, improving compliance and simplifying audits.

How to Implement Accounts Payable Automation

The implementation steps may vary slightly based on the specific needs of different businesses or industries. However, here is a general outline of the implementation steps involved in automating an accounts payable process.

Step 1: Assessment and Planning

- Analyze existing manual or semi-automated accounts payable processes and identify pain points.

- Determine what you want to achieve with automation. Is it improved efficiency, better query routing, or higher visibility?

- Establish measurable KPIs to assess the success of the automation project. This may include metrics like invoice processing time, cost per invoice, early payment discounts, etc.

- Develop a comprehensive project plan outlining the implementation timeline, resource allocation, budget, and milestones.

Step 2: Vendor Selection

- Explore various accounts payable automation software providers (or select a tool from the list we’ve shared above). Consider factors such as functionality, scalability, integration capabilities, user-friendliness, vendor reputation, and customer reviews.

- Prepare and issue RFPs to shortlisted vendors, outlining your specific requirements, budget constraints, and implementation timeline.

- Review and evaluate the received proposals, considering factors such as pricing, implementation support, customization, and ongoing customer support.

- Based on the evaluation, select the vendor that best aligns with your requirements and negotiate contract terms.

Step 3: Data Preparation and Integration

- Clean and organize existing accounts payable data to ensure accuracy and consistency. Migrate relevant data to the new automation system.

- Integrate the accounts payable automation software with other existing systems, such as enterprise resource planning (ERP), document management, and financial systems, to allow for seamless data exchange.

If you use Gmail to handle vendor communication and invoices, Hiver makes your life incredibly easy. You don’t have to migrate data because it works on top of Gmail.

Step 4: Configuration and Customization

- Configure the accounts payable automation system to reflect your desired invoice routing and approval hierarchies.

- Define user roles and permissions within the system to ensure appropriate access levels and segregation of duties.

- Tailor the system to match your specific business needs by configuring fields, notifications, reminders, and reports.

For instance, a company can establish a hierarchical approval process for invoices based on the invoice amount. Invoices under $1,000 can be automatically approved and processed by the accounts payable team.

They can also define specific user roles and permissions within the AP system to ensure appropriate access levels and segregation of duties.

– Accounts Payable Clerk: Create and process invoices without approval.

– Department Manager: Approve invoices within their department’s budget limit.

– Finance Director: Approve invoices without any budget limit.

Step 5: Testing and Training

- Conduct extensive User Acceptance Testing (UAT) to ensure that the automation system functions as expected. Test various scenarios, including invoice entry, approval workflows, payment processing, and reporting.

- Train the accounts payable team and other relevant stakeholders on how to effectively use the new system. Address any concerns, provide documentation, and communicate the benefits of the automation to gain user acceptance.

Step 6: Go Live and Optimization

- Roll out the accounts payable automation system to production. Monitor closely during the initial period to address any issues that may arise.

- Evaluate and optimize the accounts payable process regularly by analyzing key performance metrics, obtaining feedback from users, and implementing necessary enhancements or adjustments.

- Maintain a strong relationship with the automation vendor for ongoing support, system updates, and addressing any technical issues.

Top 10 Accounts Payable Automation Software

Here’s a brief comparison of some of the top accounts payable automation software available to help you choose the best solution.

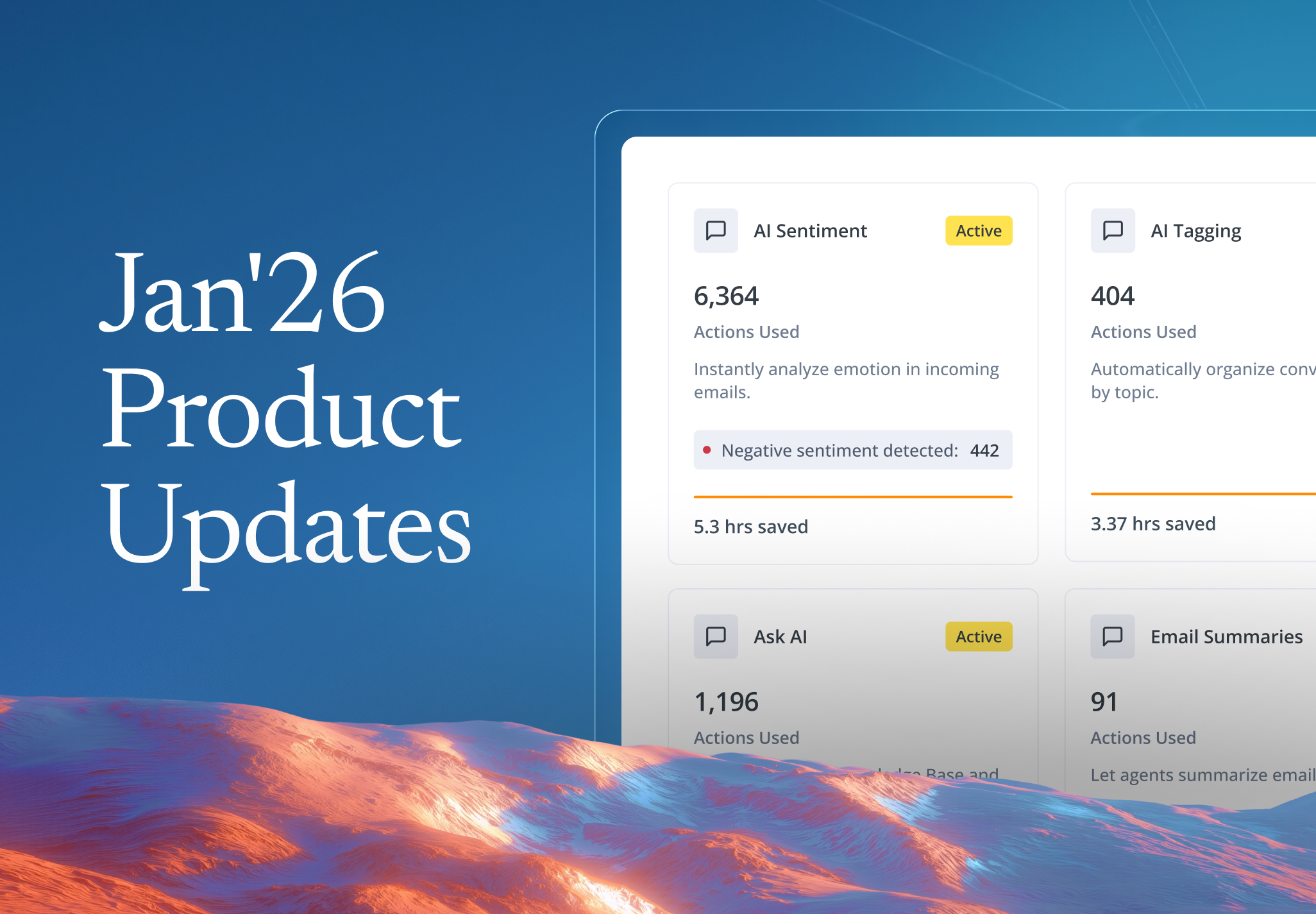

| Tool | Key Features | Price | G2 Rating |

|---|---|---|---|

| Hiver A platform that brings all your finance operations inside Gmail | Accounts Payable, Approval Workflows, Accounting Operations, Payable Automation, Email Management | Starts at $19 per user per month. Free forever plan is available. | ⭐4.6 |

| Tipalti A payment automation and management software | Supplier Management, Invoice Management, Payment Remittance, Payment Reconciliation, Purchase Order Matching | Starts at $149 per month per user | ⭐4.5 |

| BILL Finance automation software for SMBs and accounting firms | ACH, BILL Checks, International Vendor Payment, Two-way Invoice Sync, Invoice Approval | Starts at $45 per user per month | ⭐4.3 |

| AvidXchange Accounts payable software solution for mid-market businesses | Paperless Invoice Processing, Electronic Bill Payment, Purchase-to-Pay Automation, Invoice Management, E-Payments | Not provided by the vendor | ⭐4.4 |

| MineralTree Comprehensive AP software for mid-sized companies | Invoice Capture, Invoice Approval, Payment Authorization, Payment Optimization, AP Analytics | Not provided by the vendor | ⭐4.6 |

| Stampli End-to-end accounts payable automation software for businesses of all sizes | Invoice Processing, Centralized Collaboration, Multi-Entity Payment Support, Vendor Management, AP Insights | Not provided by the vendor | ⭐4.7 |

| Spendesk End-to-end spend management platform for finance teams | Accounting Automation, Invoice Management, Business Budgeting, Spend Control, Reports | Not provided by the vendor | ⭐4.7 |

| PayEm Spend management system for finance and procurement teams | Spend Management, AP Automation, Procure-to-Pay, Cross-Border Payments, Custom Approvals | Not provided by the vendor | ⭐4.8 |

| Lightyear Accounts payable software tool built for SMEs and Enterprises | Multi-tiered Approvals, Automated Bookkeeping, Automated Statement Reconciliation, Duplicate Bills Flagging | Starts from $125 per month | ⭐5.0 |

| Xero Accounting software platform for small businesses | Bill Payment, Bank Integrations, Bank Reconciliation, Accounting Dashboard, Reporting | Starts at $13 USD per month | ⭐4.3 |

1. Hiver

Hiver allows finance teams to manage accounts payable operations directly from their Gmail and Outlook inbox. It facilitates collaboration on vendor emails, ensuring timely communication, payment, and tracking. Moreover, it also offers a free forever plan with email management and collaboration features.

Key Features:

- Collaborate on invoices, cash collection requests, and bookkeeping queries directly from your inbox.

- Initiate and get approvals on invoice processing, reimbursements, and discounts-related requests within Gmail and Outlook.

- Easily set up multi-step approval workflows with approvers across departments.

- Assign, track, and collaborate on vendor emails to ensure timely communication and payment.

- Set up rules to auto-assign specific types of vendor queries or invoice-related emails to the right team members.

- Generate reports on AP-related metrics to gain insights into payment timelines, vendor communication, and more.

2. Tipalti

Tipalti is a comprehensive accounts payable automation solution designed to streamline the entire AP process, from invoice capture to payment.

Key Features:

- Automate the capture, processing, and approval of invoices.

- Make payments to vendors across the globe in multiple currencies.

- Automated supplier onboarding with a self-service portal.

- Automatically reconcile payments and generate detailed financial reports.

3. BILL

BILL offers a comprehensive accounts payable automation solution that streamlines the AP process from invoice capture to payment. It reduces manual tasks, enhances efficiency, and provides a centralized platform for all AP-related activities.

Key Features:

- Vendors can email digital invoices directly to a dedicated Accounts Payable inbox, and the platform processes them automatically upon arrival.

- Powered by BILL Artificial Intelligence, the platform reads incoming invoices using Optical Character Recognition, extracting and entering data for review.

- Users can choose from various payment methods, including ACH, virtual card, international wire, or paper check.

- The platform can perform invoice matching and purchase order matching, flagging potential duplicates to prevent double payments.

4. AvidXchange

AvidXchange provides a robust accounts payable solution designed to automate the entire AP process. It offers a combination of features to transform how companies pay their bills, making the process more efficient and reducing manual work.

Key Features:

- Capture and process invoices electronically, reducing paper and manual data entry.

- Set up custom workflows to ensure invoices are reviewed and approved by the appropriate personnel.

- Offer a range of payment methods, including ACH, credit card, and more.

- Maintain a centralized database of vendor information, payment terms, and communication history.

5. MineralTree

MineralTree provides an end-to-end accounts payable automation tool that streamlines the entire AP process, from invoice capture to payment. The platform enhances efficiency, reduces manual tasks, and integrates seamlessly with ERP solutions.

Key Features:

- MineralTree automatically extracts both header and line-level information from invoices with near-perfect accuracy.

- The platform offers flexibility in defining approval rules, allowing invoices to be routed to specific approvers in real time. Approvals can be made from anywhere, even on mobile devices.

- MineralTree connects invoices with their corresponding POs, enabling the invoice to bypass approvals and proceed directly to payment scheduling and execution.

- The platform streamlines the payment process, allowing users to select preferred payment dates, take advantage of early payment discounts, and ensure payments are made accurately and on time.

6. Stampli

Stampli is an interactive accounts payable automation platform that streamlines communication throughout the invoice processing workflow. It emphasizes collaboration between AP teams, approvers, and vendors to resolve issues and questions quickly.

Key Features:

- Stampli’s AI, named Billy the Bot, learns from user behavior to automate invoice coding, identify duplicates, and streamline the approval process.

- Users can set up dynamic approval workflows based on various criteria, such as amount, vendor, or department.

- The platform provides a real-time audit trail for every invoice, capturing all interactions, comments, and changes.

- Stampli offers vendors a self-service portal that allows them to track invoice status, communicate with buyers, and update their details.

7. Spendesk

Spendesk is a spend management platform that offers features which can support and streamline the accounts payable process.

Key Features:

- Capture and categorize invoices, ensuring that they match the appropriate department or project.

- Set up custom workflows to ensure that invoices go through the necessary approval processes before payment.

- Issue virtual and physical cards for one-off or recurring expenses, providing a controlled way to manage company spending.

- Spendesk can integrate with various accounting tools, ensuring that all financial data is synchronized and up-to-date.

8. PayEm

PayEm is a spend management platform that provides businesses with tools to manage, control, and analyze their expenses. It offers features that can help streamline the accounts payable process.

Key Features:

- Automate the capturing and processing of invoices, doing away with manual data entry.

- Define custom workflows based on various criteria to ensure that invoices are reviewed and approved by the right stakeholders.

- Schedule payments based on due dates, ensuring timely payments and avoiding late fees.

- Track and manage all expenses in one platform to get a holistic view of company spending.

9. Lightyear

Lightyear is a cloud-based accounts payable automation platform. It offers features that help businesses capture, process, and pay invoices efficiently while providing real-time visibility into their AP operations.

Key Features:

- Lightyear uses advanced OCR technology to automatically extract data from invoices, reducing manual data entry.

- Set up custom workflows to ensure that invoices are reviewed and approved by the appropriate stakeholders.

- Unlike many AP solutions, Lightyear can extract line-item details from invoices, providing a deeper level of data for analysis.

- Suppliers can submit invoices directly to the platform, and businesses can communicate with them in real-time to resolve any queries.

10. Xero

Xero is a comprehensive cloud-based accounting software that offers a range of features, including those specifically designed for accounts payable. It allows businesses to manage their bills, expenses, and supplier payments in one centralized platform.

Key Features:

- Capture and organize bills in one place, ensuring that they are paid on time.

- Pay multiple bills at once, streamlining the payment process.

- Set up recurring bills for regular expenses, ensuring that they are captured and paid automatically.

- Define custom approval processes to ensure that bills are reviewed by the right people before payment.

How to Select an Accounts Payable Software

Selecting the right Accounts Payable (AP) software is crucial for optimizing your financial processes and ensuring smooth operations. Here are some tips:

- Understand Your Requirements: Clearly define what you need from AP software. Consider the volume of invoices, the complexity of your payment processes, and specific features you need, such as multi-currency support, integration capabilities, or mobile access.

- Integration with Existing Systems: The AP software should seamlessly integrate with your existing financial systems, ERP, or accounting software. If you’re just starting a bookkeeping business or a company, also look at scalability – how easy different solutions will be to adjust as your company grows.

- Ease of Use: Choose software that is user-friendly and requires minimal training.

- Automation Features: Look for robust automation capabilities, such as automated invoice data capture, three-way matching, and electronic payment processing.

- Scalability: The software should be able to grow with your business. Consider whether it can handle an increasing volume of transactions and if you can easily add new users or features as needed.

- Security and Compliance: Ensure that the software adheres to industry security standards and can help you comply with regulatory requirements. Features like role-based access control, audit trails, and data encryption are important.

- Vendor Reputation and Support: Research the vendor’s reputation, including customer reviews and case studies. Good customer support is crucial, so look for comprehensive support services vendors.

- Customization and Flexibility: The software should allow some level of customization to fit your specific processes and workflows. Check if you can customize approval workflows, reporting, and other features according to your business needs.

- Pricing Structure: Understand the pricing structure and consider the total cost of ownership, including implementation, training, and maintenance fees.

- Trial and Demos: Before making a final decision, request a demo or a trial period to test the software’s features and ensure it meets your expectations.

Automate Accounts Payable Inside Gmail

Accounts payable software like Hiver allows you to manage and streamline finance-related operations directly within Gmail. Hiver offers convenient approval workflows within the Gmail platform, enabling you to easily initiate, monitor, and receive approvals for various requests such as invoice processing, reimbursements, and discounts.

Additionally, it empowers you to create multi-step approval processes involving approvers from different departments, further enhancing efficiency and collaboration. By facilitating prompt communication and timely payments with Hiver, you can optimize your workflow and strengthen your vendor relationships.

Get started with Hiver today. Free for 7 days.

Frequently Asked Questions (FAQs)

- What is an AP automation tool?

An AP automation tool streamlines the accounts payable process by automating invoice data capture, approval workflows, and payment processing tasks. It reduces the manual effort in managing finance operations, minimizes errors, and helps strengthen vendor relationships.

2. What is the importance of AP automation?

AP automation helps in:

- Automating invoice processing and approvals.

- Reducing manual tasks, freeing up staff for strategic work.

- Lowering processing costs and capitalizing on early payment discounts.

- Better control and oversight of financial operations.

- Adherence to financial regulations and standards.

3. How do you automate an AP process?

To automate the Accounts Payable (AP) process:

- Adopt Electronic Invoicing: Convert all invoices to digital format for faster processing.

- Set Automated Workflows: Implement rules-based workflows for quick invoice approvals.

- Integrate Systems: Connect AP software with other financial systems to streamline operations.

- Implement Advanced Technologies: Utilize OCR, machine learning, and AI to improve accuracy and reduce errors.

4. How does Hiver ensure the smooth handling of Accounts Payable tasks in your inbox?

Hiver streamlines Accounts Payable (AP) tasks within Gmail using the following features:

- Shared Inbox Management: Manages group emails like payables@ directly from Gmail. You don’t need a separate software.

- Task Automation: Automatically assigns and tags emails based on specific keywords. For instance, the billing team can be assigned all queries with the keyword ‘invoice’ in the subject line.

- Approval Workflows: Facilitates multi-step financial approvals directly within Gmail.

- Collaboration Tools: Allows team members to have quick, internal discussions on vendor queries.

- Integration with Tools: It connects with other finance operations tools, like QuickBooks. This helps centralize financial information and reduce back-and-forth between tools.

- Reminders and Alerts: Set up reminders for due dates to ensure timely payments.

Skip to content

Skip to content