Imagine filing an insurance claim and waiting weeks for an update.

For many customers, that used to be the norm.

Now, the same claim can be processed in minutes. That’s the shift AI is making possible.

AI is quickly becoming central to how financial institutions operate. From claims processing to risk assessment and fraud detection, teams are redesigning core workflows with AI at the center of decision-making.

And data backs this shift, too. According to Gartner, AI adoption in finance departments jumped to 58% in 2024, up from just 37% the year before.

So if you work in finance and are wondering how to apply AI in practical, meaningful ways, this article breaks down real-world use cases, the benefits they deliver, and how to get started.

Let’s dive in!

Table of Contents

- What is AI in Finance?

- 10 Real-World Use Cases and Examples for AI in Finance

- 1. AI-Powered Customer Support in Digital Banking

- 2. AI Agents for Back-Office Ticket Automation

- 3. Generative AI for Financial Document Intelligence

- 4. AI-Enhanced Financial Risk and Scenario Modeling

- 5. AI-Powered Anti-Money Laundering and Transaction Monitoring

- 6. AI for Expense Management and Spend Controls

- 7. AI-Driven Collections and Delinquency Management

- 8. Generative AI Copilots for Relationship Managers and Advisors

- 9. AI for Treasury and Cash-Flow Forecasting

- 10. AI-Optimized Financial Operations and Shared Services

- Benefits of Using AI in Finance

- How Does AI Improve Customer Support in Finance?

- The Future of AI in Finance: What Does it Look Like?

- Give Your Finance Ops a Boost With Hiver’s AI

What is AI in Finance?

AI in finance refers to using technologies like machine learning, natural language processing, and predictive analytics to automate workflows, improve decisions, and personalize customer experiences.

It’s especially good at analyzing massive datasets, spotting patterns, and making real-time predictions—things that are tough and time-consuming for humans to do manually.

That means faster fraud detection, more accurate forecasts, and smarter support at scale.

But AI isn’t a one-time solution you “plug in” and forget. As Dr. Manuela Veloso, Head of AI Research at JPMorgan Chase, said on Deloitte’s AI Ignition podcast:: “The challenge is to think of AI not as a one-shot kind of system but as a road … AI is like a journey, which becomes better over time.”

With financial institutions today, this journey is already well underway. Let’s look at how leading financial institutions are putting AI to work.

10 Real-World Use Cases and Examples for AI in Finance

1. AI-Powered Customer Support in Digital Banking

Financial institutions handle thousands of customer inquiries daily—from balance checks to fraud disputes. For support leaders, that means managing high volumes without sacrificing speed or accuracy.

That’s where generative AI comes in. Tools powered by large language models can now handle routine questions, summarize long threads, and surface key context to agents, cutting handle time and boosting first-contact resolution.

Banks are also integrating AI into internal support operations for finops, policy, and tools support, where AI CoPilots assist teams with transaction questions, policy lookups, and exception handling in real time.

A real-world example of this in action is DBS Bank. In 2024, DBS rolled out a GenAI-powered “CSO Assistant” to its customer service officers, giving agents real-time guidance and answers during live customer interactions.

The bank also launched DBS-GPT, an internal GenAI tool used by over 25,000 employees across support and operations to handle queries faster and with more consistency.

🌞 Did you know? Hiver’s AI Copilot is built for this exact workflow

Hiver’s AI Copilot is designed to assist agents in real time while they handle customer conversations. It lives inside the helpsdesk and focuses on helping agents respond faster and more consistently, without changing how they already work.

During live interactions, AI Copilot supports agents by:

- Summarizing long or complex threads so agents can quickly catch up on context

- Suggesting replies based on the conversation and internal knowledge

- Refining tone, clarity, and structure to help agents send polished, on-brand responses

- Pulling relevant details from past tickets, documents, or knowledge bases automatically

Instead of automating decisions, Copilot stays firmly in the assistive layer. Agents remain in control, while AI removes friction from writing, understanding, and responding.

The result is faster handling times, more consistent communication, and less cognitive load for frontline teams.

2. AI Agents for Back-Office Ticket Automation

Finance teams are increasingly using AI to classify, route, and resolve internal tickets related to invoices, reimbursements, spending limits, card issues, and access requests.

The shift is already paying off. Today, 52% of accounts payable professionals spend fewer than 10 hours a week processing invoices, down from 62% a year ago, largely due to the adoption of such time-saving automation.

AI, especially large language models, can now read invoices, contracts, and statements, extract the right data, and recommend next steps, whether it’s auto-approving a request, flagging exceptions, or routing to the right person.

As a result, teams reduce manual handoffs and cut down on back-and-forth between operations, risk, and support.

🌞Did you know?

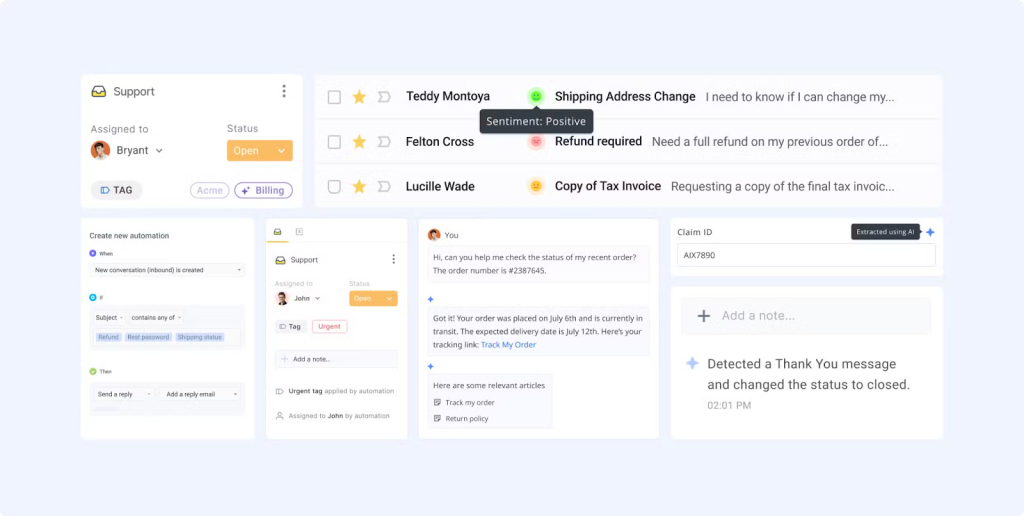

While Hiver’s AI Copilot supports agents during live conversations, Hiver’s AI Agents are designed to work independently in the background.

Once set up, AI Agents automatically analyze each request. They categorize tickets, detect urgency and sentiment, extract key details like invoice or claim numbers, and route the ticket to the right team or workflow with minimal manual effort.

For repeatable cases, they can even resolve tickets end-to-end, reducing ticket volume and helping teams stay on top of SLAs.

Hiver structures this automation through two core agents:

- AI Triage Agent, which organizes, prioritizes, and routes tickets based on context like category, urgency, and sentiment

- AI Resolution Agent, which handles routine transactional requests such as status checks, standard approvals, follow-ups, or escalations

And when something needs a human decision, agents can use Ask AI to quickly pull the right answer from internal knowledge, past conversations, or documents, without switching tabs or hunting for context.

3. Generative AI for Financial Document Intelligence

Financial documents are notoriously dense and time-consuming to work through.

That’s why more banks and insurers are turning to generative AI to handle the heavy lifting. According to a KPMG report, large language models are now being used to scan financial documents, extract critical details (like party names, policy terms, and coverage limits), and even pre-fill onboarding and risk systems.

Instead of spending hours on manual reading and data entry, teams can now focus on reviewing, validating, and making decisions.

Recommended reading

4. AI-Enhanced Financial Risk and Scenario Modeling

Risk teams are starting to use AI to keep a closer, more continuous eye on what’s happening around them.

Instead of relying solely on periodic reports, AI systems scan signals such as news, regulatory filings, market data, and macroeconomic indicators and feed them into credit and market risk models.

These models can then quickly simulate different scenarios, such as interest rate hikes, currency swings, or liquidity stress, and show how portfolios might be affected.

Reports from organizations like the OECD point to the same shift: AI helps risk teams spot emerging risks earlier and adjust exposures faster, rather than reacting after the fact.

5. AI-Powered Anti-Money Laundering and Transaction Monitoring

Anti-money laundering is one area where AI is already making a clear, measurable impact.

In 2023, HSBC deployed an AI-based AML monitoring system called Dynamic Risk Assessment with Google Cloud. The system processes over 1.35 billion transactions per month and reduces false positives by about 20%.

But what’s the edge with using AI for this?

Modern AML systems use techniques like anomaly detection and graph analysis to understand how accounts, cards, and entities are connected across channels. This helps surface subtle laundering patterns that static rules often miss.

Over time, these systems also learn from investigator feedback. Each cleared or confirmed case helps improve future alerts, so compliance teams spend less time reviewing low-risk activity and more time focusing on genuinely suspicious cases.

6. AI for Expense Management and Spend Controls

Corporate finance and finops teams are increasingly deploying AI to automate employee expense review, policy enforcement, and anomaly detection.

AI models can read receipts, categorize spend, and flag policy violations or suspicious patterns.

Instances such as split transactions, repeated merchants, and other anomalies are better detected with AI compared to manual audits.

Some platforms also use AI to forecast spend by category or department, helping CFOs adjust budgets and identify areas where costs can be optimized without impacting operations.

7. AI-Driven Collections and Delinquency Management

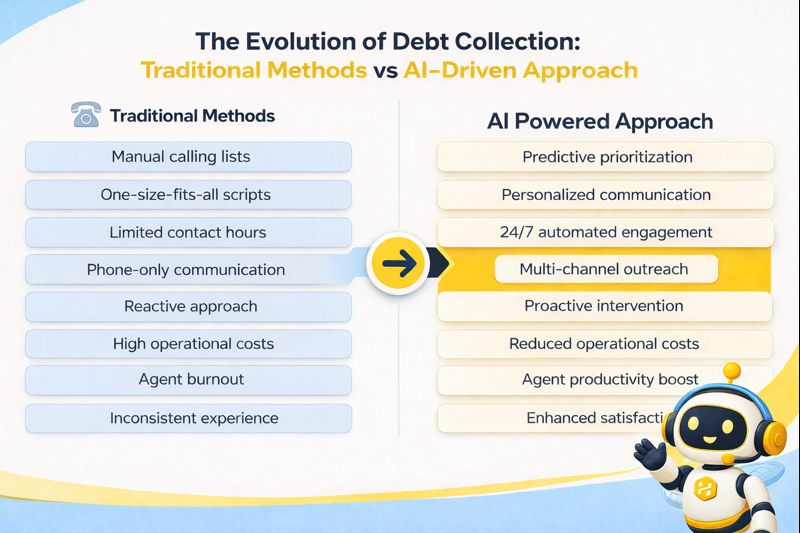

Fintech lenders and collection teams are increasingly using AI to understand which customers are likely to fall behind on payments and how best to engage them.

Instead of treating every overdue account the same, AI looks at repayment history, recent behavior, and other signals to help teams decide who needs outreach first.

This shift is already visible in the data. Industry summaries by TransUnion show that about 11% of U.S. collection companies were using AI in 2023, and that number increased to 18% in 2024.

Among companies that have adopted AI, 58% use it specifically to predict payment outcomes or a customer’s willingness or ability to pay.

Based on these insights, teams can tailor their approach. AI can suggest the right time to reach out, the best channel to use, and whether to offer options like a payment reminder, a revised plan, or temporary relief.

At the same time, routine reminders and follow-ups can be automated, while agents receive guidance on next-best actions during conversations.

8. Generative AI Copilots for Relationship Managers and Advisors

Relationship managers and advisors spend a surprising amount of time preparing for client conversations.

To cut that effort down, wealth and corporate banking teams are starting to use generative AI copilots embedded directly into CRM and portfolio tools.

These copilots pull together client history, recent transactions, past meetings, and market context to surface talking points, risk notes, and draft personalized outreach before a call.

And Industry research backs the impact. Analysis from Oliver Wyman and McKinsey suggests that AI copilots can save up to 30-40% of the time spent preparing customized client talking points, and deliver measurable efficiency gains of around 9% in client-facing roles.

The net effect is simple: less prep work, faster responses, and more time spent in meaningful, high-value client conversations.

Recommended reading

9. AI for Treasury and Cash-Flow Forecasting

Banks and large enterprises are starting to use machine learning to improve how they forecast cash flows.

Instead of relying on static spreadsheets, these systems predict inflows and outflows more accurately and help teams manage liquidity with greater confidence.

Recent treasury research shows that AI-driven models can significantly improve short-term cash-forecast accuracy, with one study reporting a reduction in forecast error from roughly 24.7% to under 10%.

Based on projected cash positions and risk appetite, the models can suggest actions such as short-term funding, hedging, or investment placements, helping treasury teams act faster and with better insight.

10. AI-Optimized Financial Operations and Shared Services

Finance operations teams use AI agents to handle high-volume back-office tasks such as vendor onboarding, purchase order matching, invoice exception handling, and general ledger coding.

Large language models can read unstructured emails and documents, map them to finance workflows, and either auto-resolve or create structured tasks, significantly reducing cycle times and error rates.

Recommended reading

Benefits of Using AI in Finance

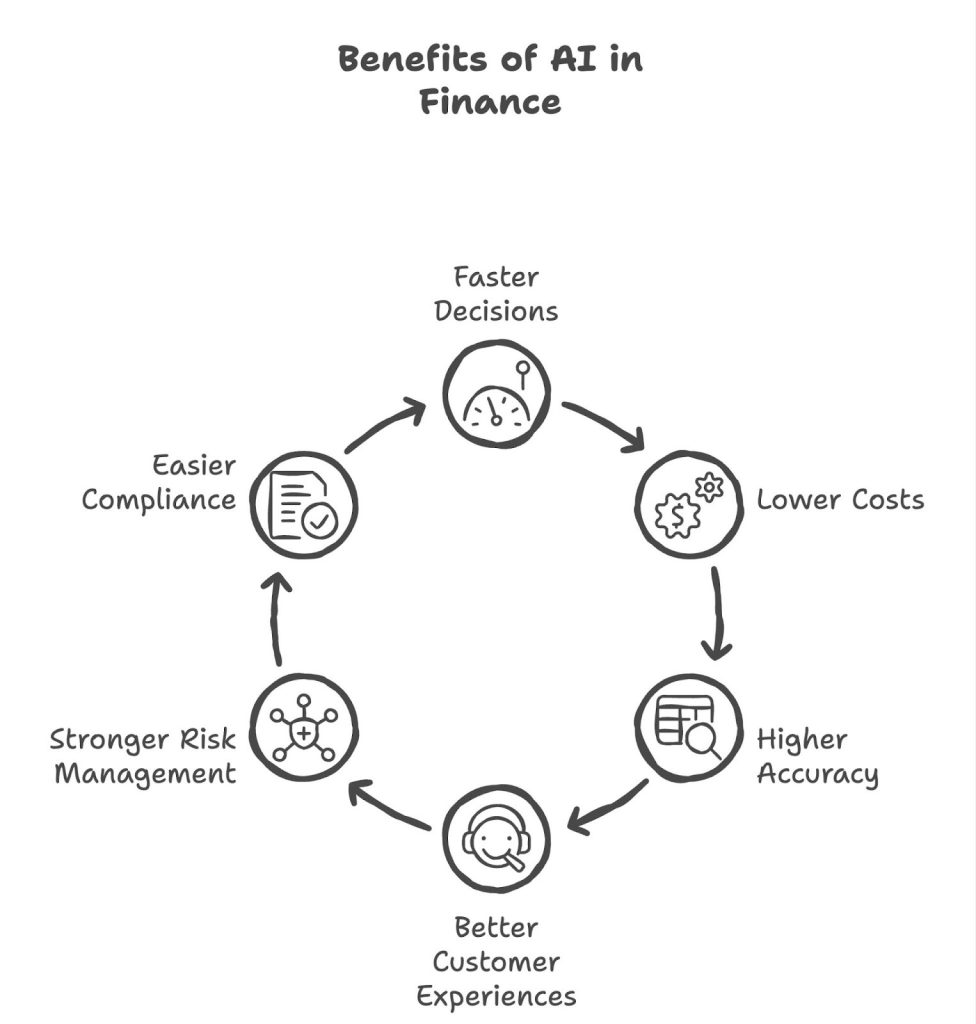

AI’s impact in finance goes well beyond basic automation. Here’s what teams are seeing in practice:

Faster decisions

AI processes large volumes of data in seconds. Credit approvals and risk checks that once took days or weeks can now happen in minutes.

Lower operational costs

By automating repetitive work, teams spend less time on manual tasks and more time on higher-value activities.

Higher accuracy

AI reduces common sources of human error, especially in data entry, document review, and compliance checks.

Better customer experiences

Customers get quicker responses, more relevant recommendations, and round-the-clock support. For support and advisory teams, AI makes it easier to deliver consistent, personalized service at scale.

Stronger risk management

AI can spot patterns and anomalies that are easy to miss, from fraud and money laundering to early market shifts. This gives teams more time to respond before issues escalate.

Easier regulatory compliance

AI helps monitor transactions continuously, flag suspicious activity, and maintain clear audit trails in real time, reducing compliance effort and surprises during reviews.

How Does AI Improve Customer Support in Finance?

Customer support in finance comes with unique challenges. Queries are often complex, regulations are strict, and customers expect fast, accurate answers.

But with AI, here’s how financial institutions can handle support better:

Understanding intent faster: AI detects what customers need from their first message. Whether it’s a balance inquiry, fraud alert, or loan question, the system routes it correctly and pulls relevant context.

💼Case study: How Craftgate used Hiver for AI-driven fintech support

Craftgate is a payment orchestration platform that helps fintechs and merchants manage multiple payment methods from a single system. As their customer base grew, their support team started handling close to 100 queries a day, all coming into a shared Gmail inbox that was no longer scaling.

To fix this, Craftgate moved to Hiver and set up automated assignment and routing, so every incoming request was clearly owned and categorized from the moment it arrived.

While this started as a way to bring order to day-to-day support, it also laid the groundwork for using AI more effectively.

With clean, labeled conversations and consistent workflows in place, the team can now layer in AI-driven triage and insights without chaos. Today, Craftgate handles over 700 conversations a month and saves more than 130 hours every month.

Summarizing complex cases: Financial conversations can span multiple emails, calls, and documents. AI summarizes the entire history, so agents don’t waste time catching up.

Drafting compliant responses: AI suggests replies that align with your tone and regulatory requirements. Agents review, tweak if needed, and send—maintaining quality while moving faster.

Tracking customer sentiment: AI monitors tone and flags conversations where customers are frustrated or confused. Teams can prioritize these cases and respond with empathy.

Automating routine tasks: Simple queries—balance checks, transaction confirmations, password resets—get handled by AI, freeing agents to tackle complex issues like disputes or account reviews.

💼 Case study: How Pattern Life cut manual triage with AI-ready workflows using Hiver

Pattern Life supports thousands of physicians and insurance carriers, which means a constant stream of time-sensitive, detail-heavy emails. Earlier, teams spent hours sorting messages and switching to Salesforce just to figure out who owned each request.

By integrating Salesforce with Hiver, client details like account ownership and policy context now appear right beside every conversation.

Pattern Life then added over 50 automation rules to route requests, flag priorities, and keep queues clean.

With structured, context-rich conversations in place, the team is well-positioned to layer AI features like conversation summaries and suggested replies on top. The impact was immediate: routing became 60% faster, and weekend backlogs dropped from hours to minutes.

Providing multilingual support: AI-powered chatbots can assist customers in multiple languages, breaking down barriers and improving accessibility.

The outcome? Support teams become more efficient, customers get better experiences, and financial institutions build stronger relationships.

The Future of AI in Finance: What Does it Look Like?

AI is already part of finance, but most institutions are still early in the journey. What’s changing next is not how much AI is used, but how deeply it’s embedded into everyday work.

- Hyper-personalization: AI will tailor products, advice, and support at an individual level, based on real behavior, goals, and risk profiles.

- Real-time decision intelligence: Credit, risk, and service decisions will happen instantly, with models updating continuously as conditions change.

- AI embedded into daily workflows: Instead of separate tools, AI will live inside CRMs, compliance systems, and support inboxes, working quietly in the background.

- Explainable AI: As regulations tighten, institutions will expect AI systems to clearly explain decisions, especially in credit, fraud, and compliance.

Proactive compliance: AI will help teams spot emerging risks and regulatory gaps early, not just react after issues appear.

Taken together, these shifts point to a future where AI is less about experimentation and more about dependable, day-to-day decision support across financial operations.

Give Your Finance Ops a Boost With Hiver’s AI

AI is no longer optional in the finance industry. It’s already changing how institutions serve customers, manage risk, and make decisions every day.

The most effective AI setups focus on real problems, like helping teams respond faster, giving customers clearer answers, and staying compliant without extra effort.

That’s where Hiver comes in. Hiver brings AI directly into your support operations, helping teams understand intent, summarize conversations, draft better replies, and route complex cases with context.If you’d like to see how AI can simplify your support operations without changing how your team works, you can try Hiver for free, today!

Skip to content

Skip to content