In fintech, customer service isn’t a back-office function but part of the product experience.

When someone reaches out, they’re likely dealing with something urgent: a blocked card, a failed transaction, or a payout that didn’t land. You could see these as support tickets but the only difference being the margin for error is slim and any delays can directly impact people’s money and trust.

And because fintech companies don’t have physical branches to fall back on, support teams carry the full weight of reassurance. The experience needs to be fast, clear, and easy — just like the app.

In this guide, we’ll walk through what it takes to build a fintech support function that scales without losing the human touch. You’ll find:

- What fintech customer service really involves

- The tools that help support teams resolve issues faster and more accurately

- Best practices we’ve seen work in high-volume fintech environments

- Common support mistakes that quietly drain user trust

If you want to learn beyond this post, I’d recommend tuning into these podcasts that often explore support and CX in fintech:

🎧 Fintech Insider by 11:FS: Great real-life stories and CX breakdowns

🎧 What the FinTech?: Unpacks operational challenges with industry leaders

🎧 Deciphered by Bain: Sharp insights on building customer-first fintech products

Table of Contents

- What is fintech customer service?

- Importance of customer service in the fintech industry

- How fintech companies are using AI in customer service

- Top 5 tools to streamline fintech customer service

- What fintech companies should be doing vs where they are going wrong in supporting customers

- What matters most in fintech customer service

- Frequently Asked Questions (FAQs)

What is fintech customer service?

Fintech customer service is the support layer that helps users complete critical financial actions inside a fully digital product. Whether it’s transferring money, verifying identity, applying for credit, or resolving a failed transaction, there’s no branch to walk into, and no relationship manager to call.

Support is the only human touchpoint. And that means it needs to deliver on three things: speed, clarity, and reassurance.

In most scenarios, support requests are time-sensitive. If a user gets locked out or a transaction fails, even a short delay can cause frustration – or worse, churn. That makes fintech support uniquely high-pressure and high-impact.

I’ve come across some fintech companies that are setting a high standard in customer service, and their approaches could inspire you:

- Starling Bank offers a mobile-first experience with real-time spending insights, in-app support, and instant notifications that reduce the need to contact support in the first place.

- Monzo focuses on community-driven product development and fast, friendly in-app help. Customers can flag issues or suggest features directly, creating a feedback loop that actually works.

- Revolut combines budgeting, international transfers, and savings tools in one app — backed by 24/7 support and multi-currency account management. Its service scale matches its global product reach.

- Atom Bank delivers a 100% digital banking experience with strong personalization, including biometric logins, app-based support, and customized lending options.

Importance of customer service in the fintech industry

Here’s why providing exceptional customer service is so important for fintech companies:

1. Your service is your only branch

Unlike traditional financial institutions, fintech companies don’t have physical locations where customers can go for help. Your app, website, and digital customer service channels are the only ways customers interact with your business.

- The lack of a physical branch means that any issue a customer has must be resolved through your digital channels. If these channels aren’t useful, customers have no alternative way to get the help they need.

- The customer service you provide is a major part of the overall experience with your product. If it’s falling short, customers won’t hesitate to switch to a competitor. In fact, we found out that 72% of customers switch brands after just one negative experience.

Tips you can implement:

- Provide round-the-clock support so that customers can get help whenever they need it, regardless of time zones or emergencies.

- Offer support through multiple channels like chat, email, website, and social media, giving customers multiple ways to reach you.

- Use chatbots to handle basic queries instantly, freeing up human agents to deal with more complex issues.

For instance, Bank of America’s AI chatbot, Erica, combines financial advice with customer support. Erica helps customers manage their banking by giving real-time updates on transactions, assisting with bill payments, and offering financial tips, making banking easier and less stressful. Erica shows how chatbots, when used well, can reduce customer issues and improve your support metrics.

Recommended reading

2. You’re personally managing people’s finances

In fintech, you’re handling something incredibly personal and critical: people’s money. The stakes are high because your service quality can directly impact their lives. Even a small mistake or delay can have significant consequences.

- Customers are entrusting you with their hard-earned money, so any misstep, like a delayed payment, could cause them to miss bill deadlines, incur late fees, or even damage their credit scores.

- Trust is the foundation of everything in fintech. If customers feel their money isn’t safe or that their transactions aren’t handled efficiently, they’ll quickly lose confidence in your platform.

Tips you can implement:

- Keep customers informed about every transaction, reducing anxiety over whether their money is where it needs to be.

- Offer a priority support line for urgent financial issues, like transfer error, payment gateway failure, fraudulent transaction, etc.

- Use multi-factor authentication to add an extra layer of security, making sure that only authorized users can access their accounts.

3. Playing by the rules builds trust amongst your customers

In the fintech industry, customer complaints are not just a sign of dissatisfaction—they can also lead to scrutiny. Regulatory bodies, like the Consumer Financial Protection Bureau (CFPB) in the U.S., may require you to report complaints.

- A poor track record with customer complaints can lead to fines, penalties, or even the suspension of your services.

- Being under regulatory investigation can severely damage your reputation, making it harder to attract and retain customers.

- Compliance issues can disrupt your business operations, leading to downtime or additional costs to rectify problems.

Tips you can implement:

- Address issues, like slow response times, technical glitches, and account security before they escalate into formal complaints.

- Keep customers informed about their rights, such as access to funds or privacy protection.

Recommended reading

4. Going the extra mile wins customer loyalty

Companies that excel in customer service often outperform their competitors, both in customer satisfaction and financial performance.

- Satisfied customers are more likely to recommend your services to others, recommend your service to others and become advocates of your brand.

- Companies with high customer satisfaction scores often see better financial results, as happy customers tend to spend more and remain loyal over time.

Tips you can implement:

- Personalize customer interactions based on individual preferences and history, making each customer feel valued and understood.

- Collect customer feedback regularly and use it to refine your services. This will show customers that you listen and care about their experience. Use surveys to gather insights into what customers like and what needs improvement.

Like, you can use Hiver’s built-in CSAT survey to gather real-time feedback after every customer interaction. You can also easily track satisfaction trends, spot recurring issues, and improve support workflows.

5. Making complex digital finance simple for your users

The fintech industry involves complex financial products and services, from payment processing to cryptocurrency transactions. These complexities can often confuse customers.

- Financial products can be intimidating, especially for customers unfamiliar with the intricacies of things like blockchain or multi-currency accounts. Confusion can lead to frustration and errors. Operating a Solana node can simplify cryptocurrency transactions by ensuring high-speed validation and network reliability, making the user experience more seamless.

- Misunderstandings about complex financial products can also lead to compliance issues.

Tips you can implement:

- Provide customers with easy-to-understand guides and tutorials that explain complex financial concepts.

- Have specialized support teams for complex issues, such as cryptocurrency transactions, funding programs for startups, and calculating taxes on cryptocurrency, to offer expert assistance.

- Create an online knowledge base where customers can find answers to common questions and detailed explanations of complex services.

- Use interactive tutorials within your app to guide users through complicated processes step by step.

6. Your brand reputation depends on great customer service

Your brand’s reputation is closely tied to the quality of your customer service. Today, customers don’t hesitate to share their experiences online, and negative reviews can quickly damage your credibility.

- A strong reputation attracts new customers and retains existing ones. Conversely, a poor reputation can lead to lost business and financial instability.

- Online reviews on platforms like G2, Trustpilot or social media can influence the decisions of potential customers. A string of negative reviews can deter people from using your services.

Tips you can implement:

- Monitor online reviews and social media mentions regularly, responding quickly to any negative feedback to show that you care.

- Use tools that help you track and manage your online reputation, like ReviewTrackers and Reputation.com.

- Implement social listening tools, such as HootSuite and Brandwatch, to monitor what’s being said about your company in real-time, letting you address issues as they arise.

7. Good customer service helps scale your business and service

Scalable customer service means that even as you expand, your customers continue to receive the support they need, keeping them loyal to your brand.

- Scalability allows you to handle more customers without sacrificing service quality.

- Word-of-mouth referrals are cost-effective compared to expensive advertising campaigns.

Tips you can implement:

- Use automation to handle routine inquiries, allowing your team to focus on more complex customer issues as your customer base expands.

- Regularly assess your customer service capacity to ensure it can handle future growth, making adjustments as needed.

- Implement a referral program that incentivizes your current customers to bring in new ones.

Recommended reading

How fintech companies are using AI in customer service

Fintech support teams face unique pressure as they handle time-sensitive issues tied to money, compliance, and user trust, all without the safety net of physical branches or large call center teams.

Traditional support models don’t scale well in this environment. That’s why more fintechs are moving toward AI-assisted customer service. This is not to replace agents, but to help them respond faster, smarter, and more accurately.

Here’s how AI is showing up in their workflows:

- AI can identify patterns in real time – like a sudden spike in failed transactions or logins – and flag them before they turn into full-blown support backlogs. This gives customer service and engineering teams a head start

- Modern AI support tools can scan past tickets, detect intent, and suggest tailored responses. This speeds up replies without compromising on quality or empathy..

- Instead of using static rules, AI-powered triage systems can route issues based on urgency, topic, and even customer sentiment. This reduces first-response time and ensures complex issues land with the right specialists from the start.

- AI can keep customers informed – whether it’s sending proactive “We’re still on it” messages or closing the loop after a ticket has been resolved. That small layer of automation reduces manual work while improving transparency.

This move toward intelligent automation is part of a broader shift across finance teams. In our report, “How finance teams are losing time, trust, and money,” we surveyed over 450 finance professionals in the US. One finding stood out: 56% struggle with slow and fragmented communication, especially when dealing with customers or vendors.

These are the same friction points fintech support teams face daily, and AI is helping to smooth them out. Done well, AI in fintech isn’t about automation for automation’s sake. It’s about removing the invisible blockers so human agents can focus on high-stakes, high-trust conversations.

Top 5 tools to streamline fintech customer service

Here are some tools to streamline fintech customer service operations:

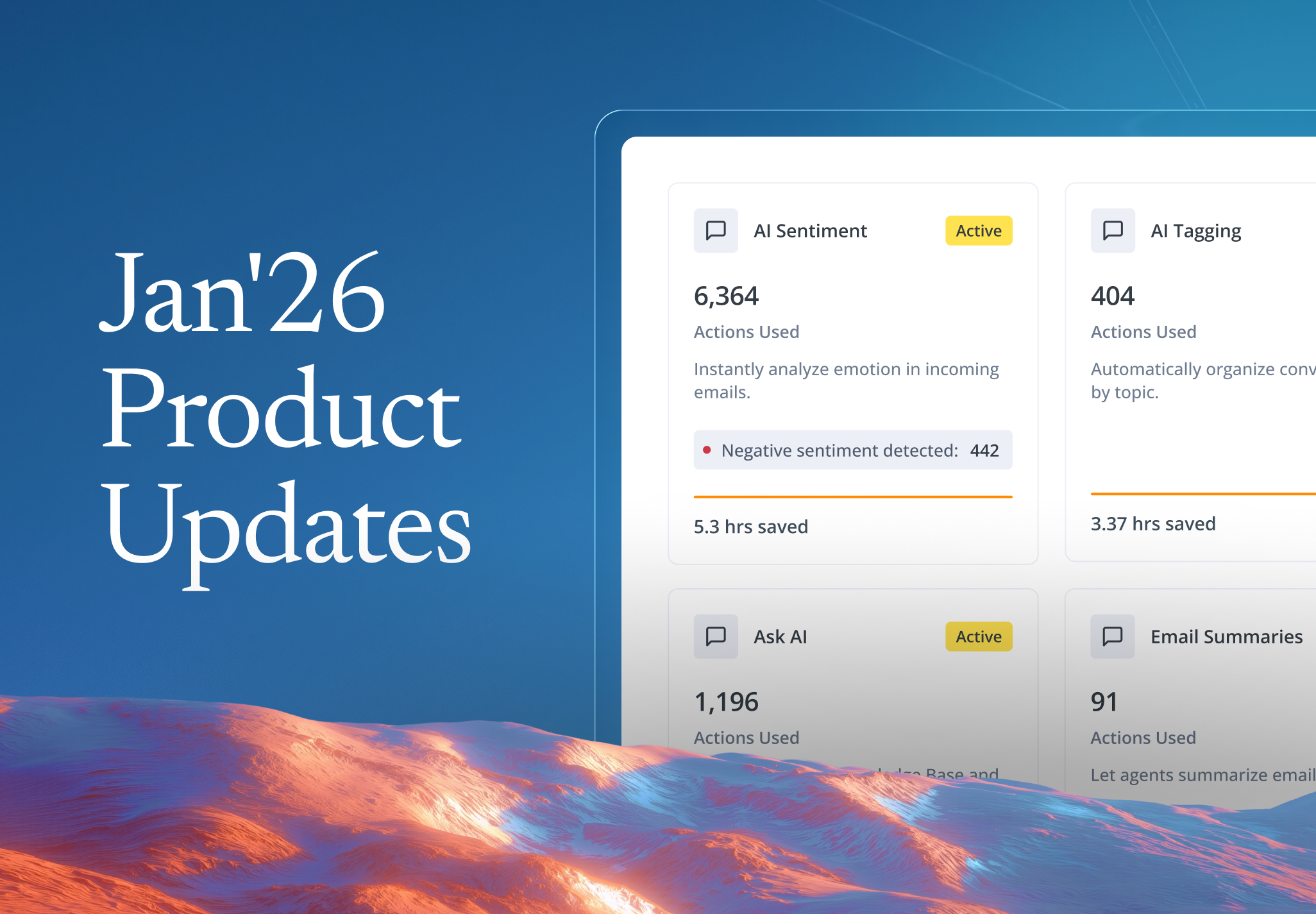

1. Hiver

Hiver is a modern AI-powered customer service platform. It helps fintech teams manage email IDs like payables@, receivables@, and payroll@ with complete clarity and control. It looks and feels just like your regular inbox, so there’s less learning curve. The left panel shows all your communication channels (email, chat, and WhatsApp amongst others) in one place, and under each channel, you can see what’s pending, what’s being worked on, and what’s resolved.

The software is especially useful for finance teams that rely on email to handle vendor communication, invoice approvals, payment queries, or employee reimbursements. Instead of juggling CCs and forwards, teams can assign ownership, collaborate using internal notes, and automate routine actions.

Hiver also integrates with over 100 tools, including ERPs and communication platforms, to keep everything connected. Plus, its support team is available 24×7 if you need help anytime.

Key features:

- Accounts Receivable (AR): Work closely with sales, legal, and account management teams to quickly address customer inquiries and clarify invoice details. Manage and monitor collections on outstanding receivables.

- Accounts Payable (AP): Easily manage emails related to invoices, payments, and vendor onboarding. Set up approval processes and integrate invoices directly into your ERP from your inbox.

- Accounting: Streamline the book closing process and enhance collaboration with different teams to better understand budgets and cash flows.

- Employee help desk: Respond efficiently to internal queries regarding reimbursements, taxes, travel, and payroll. Keep staff informed about updates to policies and procedures.

- Automate routine tasks: Set up automated workflows to tag, assign, and manage email queries efficiently. Customize automation to route emails based on keywords or team member expertise and maintain logs for easy approvals.

- Monitor team performance: Use custom reports and real-time dashboards to monitor your team’s workload. Establish SLAs and track how quickly issues are resolved to ensure accountability.

Hiver offers a 7-day free trial, and prices start from as low as $19/user/month. A free forever plan is also available.

2. Zendesk

Zendesk is a customer service platform that helps fintech companies manage conversations across email, chat, voice, and social — all from one unified dashboard. It offers tools to build automated workflows, set up a self-service help center, and track performance with in-depth analytics.

For fintech teams handling time-sensitive issues, Zendesk supports advanced features like SLA tracking, intelligent routing, and macros.

Key features:

- Omni-channel support: Handle conversations across email, chat, phone, and social media — so customers can reach you through the channel they trust most. In fintech, this flexibility is key to maintaining responsiveness and trust.

- Customizable workflows: Automate responses and route tickets based on issue type, urgency, or customer profile. This ensures sensitive financial matters are handled by the right people, fast.

- Knowledge base: Build a help center where users can find answers to common questions without waiting for a reply. It helps reduce ticket volume while giving customers more control.

Zendesk starts at $55/user/month, which can be on the higher side for smaller teams. It’s best suited for mid-size to enterprise fintechs that need robust automation, SLA tracking, and advanced analytics. A 14-day free trial is available.

3. Freshdesk

Freshdesk is a support platform built to help fintech teams organize, automate, and resolve customer queries across email, chat, phone, and social media. Its intuitive ticketing system lets you assign ownership, set priorities, and track the progress of every request — making it especially useful for small to mid-sized fintechs handling a steady flow of high-stakes questions.

Key features:

- Catalog: Build a centralized catalog for finance-related requests, from account issues and payment disputes to procurement or employee expense queries.

- AI-powered automation: Route tickets automatically based on issue type, use AI to suggest relevant responses, and speed up resolution times without compromising on accuracy.

- Self-service options: Build your own knowledge base and community forum so that customers can find solutions independently.

Freshdesk offers a free forever plan for up to 2 agents, though features are limited. Paid plans start at $50/user/month, with a 14-day free trial available.

4. Intercom

Intercom is a customer messaging platform that helps fintech companies support and engage users directly within their app or website. It’s ideal for fintechs looking to reduce drop-offs during sign-up or activation, with features like in-app messaging, interactive product tours, and conversation routing. Intercom also offers bot-based support to deflect routine queries, while handing off complex issues to human agents with full context.

Key features:

- Real-time messaging: Provide live chat support during critical customer moments, like failed payments, login issues, or ID verification delays.

- Automated bots: Intercom’s Fin AI delivers fast, accurate answers to common queries, and smoothly escalates complex cases to human agents without losing context.

- Customer engagement tools: Use in-app messages, product tours, and targeted campaigns to educate customers, increase feature adoption, and reduce support volume.

Intercom plans start at $29/user/month and include a 14-day free trial. Pricing scales quickly with usage and additional features, so it’s best suited for growth-stage fintechs with high engagement needs.

5. Kustomer

Kustomer is a CRM and support platform designed to give fintech teams full visibility into every customer interaction. Its timeline-based interface lets agents see messages, transactions, and activity history in one place — making it easier to deliver fast, personalized support without jumping between systems.

Key features:

- 360-degree customer view: Consolidates data from multiple channels, so agents can view each customer’s full journey — including previous conversations, purchases, and payment history.

- Customizable automation: Build tailored workflows to handle recurring issues, route tickets, or trigger follow-ups based on customer actions or account status.

- Integrated communication: Support customers seamlessly across email, chat, phone, social media, WhatsApp, and SMS, from a single dashboard. Every interaction is tracked in real time, so nothing slips through the cracks.

Kustomer is best suited for larger fintech teams or enterprises with complex workflows. Plans start at $89/user/month, with a 14-day free trial available.

What fintech companies should be doing vs where they are going wrong in supporting customers

Let me tell you some strategic and proactive measures fintech companies should be implementing, compared to common pitfalls that can undermine your team’s efforts.

| Aspect | What fintechs should be doing | Where they are going wrong |

|---|---|---|

| Customer-journey mapping | Creating detailed, data-driven customer journey maps to anticipate needs at every touchpoint and tailor support accordingly. | Neglecting the full customer journey. This results in disjointed support that doesn’t align with user expectations or critical pain points. |

| Omni-channel integration | Seamlessly integrating support across all channels (chat, phone, email, social media, in-app) so that customers get a consistent experience regardless of how they reach out. | Treating support channels in silos, resulting in inconsistent information and poor customer experience across different platforms. |

| Predictive support | Using AI and machine learning to predict issues before they occur and proactively reach out to customers with preventative advice. | Relying solely on reactive support models, where customers have to report issues first. |

| Advanced personalization | Leveraging advanced analytics to offer hyper-personalized support that goes beyond just name recognition—anticipating customer needs based on behavior, transaction history, and preferences. | Offering generic support that fails to address the unique needs of each customer, causing frustration and a sense of being undervalued. |

| Cultural and regional sensitivity | Adapting customer support strategies to align with cultural and regional differences. | Applying a one-size-fits-all approach that ignores regional nuances, leading to misunderstandings and alienating diverse customer groups. |

| Feedback loop optimization | Creating dynamic feedback loops where customer input directly influences product development and service enhancements. | Collecting feedback without actionable follow-through, resulting in customers feeling ignored and disengaged. |

| Crisis anticipation and simulation | Conducting regular crisis simulations to anticipate potential issues (e.g., data breaches, system failures) and developing detailed, customer-focused response plans. | Being unprepared for a crisis, with support teams scrambling to respond reactively. |

| Holistic customer experience management | Viewing customer support as part of a larger customer experience strategy, integrating it seamlessly with product design, marketing, and customer success efforts. | Isolating customer support from other departments, leading to inconsistent experiences. |

| Ethical transparency | Going beyond standard disclosures to offer transparent insights into business practices, data usage, and decision-making processes. | Providing minimal transparency, leading to skepticism and concerns about how data and finances are managed. |

What matters most in fintech customer service

Fintech support teams carry more weight than most realize. They’re often the first to hear about bugs, the last to respond during outages, and — in many cases — the only human connection in an otherwise fully digital product.

The way your support team operates has a direct impact on customer retention, compliance risk, and long-term trust.

But great fintech service isn’t about doing more but about doing the right things consistently:

- Clear processes

- Context-rich tools

- A team that knows how to stay calm under pressure without losing empathy

When these fundamentals are in place, support becomes a growth lever.

If you’re leading or scaling support in a fintech environment, start by listening. Identify repeat issues. Remove the friction. Streamline the handoffs. And choose tools that make your team’s day-to-day easier and not more complicated.

Because the faster your team can move with confidence, the easier it becomes to earn trust where it matters most.

Frequently Asked Questions (FAQs)

What makes fintech customer service different from traditional banking?

Fintech support happens entirely online. There’s no branch or in-person fallback. That makes the support team the only human touchpoint. Expectations are higher, and so is the pressure to respond quickly and clearly during sensitive moments involving money, identity, or trust.

How can fintech startups scale customer support with a small team?

Fintech startups can scale by:

Automating FAQs and low-stakes queries with bots or help docs

Using shared inboxes to avoid missed messages

Training teams on compliance and tone

Prioritizing repeat scenarios like failed payments or onboarding issues

Analyzing conversation data to improve workflows and reduce volume

What are the key KPIs for fintech customer service?

Common KPIs include first response time, resolution time, customer satisfaction (CSAT), and SLA adherence. Many teams also track volume of repeat queries and the most frequent ticket categories to spot patterns and improve proactively.

What are the biggest mistakes fintech companies make in customer service?

A few common missteps include relying too heavily on scripts that feel impersonal, taking too long to respond to urgent issues, and failing to give support agents access to complete customer history. Some teams also miss out on using support insights to inform product improvements, which can lead to repeat issues.

What tools are used in fintech customer service?

Fintech companies often use a combination of:

Shared inboxes (like Hiver) for collaborative email support

Chatbots and live chat for real-time assistance

CRMs for tracking customer history and context

Help centers or knowledge bases for self-service

Should fintech support teams be in-house or outsourced?

Early-stage fintechs often outsource for cost efficiency. But for high-risk issues like KYC, fraud, or payments, having an in-house team means tighter quality control, faster escalations, and better alignment with product and compliance standards.

How can fintech support teams handle trust issues during outages or errors?

Be proactive, transparent, and human. Even if there’s no fix yet, acknowledge the issue, explain what’s happening, and offer a timeline for updates. Clear, empathetic communication can preserve trust, even when things go wrong.

How can fintech support teams work better with product and engineering?

Create a strong feedback loop. Support teams should regularly surface ticket trends, customer pain points, and edge-case bugs to product and engineering teams. Regular syncs — even short ones — help reduce repeat issues and build better customer experiences.

Start using Hiver today

- Collaborate with ease

- Manage high email volume

- Leverage AI for stellar service

Skip to content

Skip to content