The accounts receivable process has a marked impact on a company’s cash flow. It is an indicator of how much money your business can expect to make and how much your customers owe you.

An accounts receivable process helps your business to:

- Establish the exact amount of cash that is tied up in credit invoices

- Attract investors by giving a clear picture of the company’s cash collection efficiency (the percentage of credit a business is able to collect within a specific time period)

- Maintain strong relationships with customers

- Identify mismanaged customer accounts and spot any errors in the cash flow system.

Clearly, a robust and streamlined accounts receivable process is important to make sure that there is no cash flow shortage that can negatively impact the functioning of a business.

Now, when your business is dealing with tens of thousands of customers and has to keep track of multiple payments and invoices, there needs to be a system in place to streamline all of this information.

The best course of action is to implement an accounts receivable helpdesk to ensure a smooth cash collection process.

11 Templates for Accounts Receivable from Customers

Table of Contents

- What are Accounts Receivable?

- What is an Accounts Receivable Helpdesk?

- 10 Step Process to Implementing a Global Accounts Receivable Helpdesk Process for Your Business

- 1. Evaluate your current accounts receivable workflow

- 2. Define your accounts receivable helpdesk goals

- 3. Work out your accounts receivable helpdesk workflow

- 4. Determine the number of users

- 5. Integrate with critical third party applications

- 6. Define SLAs for issue resolution

- 7. Set up self-service options for customers

- 8. Define key performance metrics

- 9. Configure accounts receivable helpdesk security settings

- 10. Deploy the helpdesk, test, and optimize

- Hiver, A Multichannel Helpdesk to Streamline Your Finance Operations

What are Accounts Receivable?

Accounts receivable shows how much money a business stands to receive from its debtors. It sums up the total amount of money customers owe your business for goods and services purchased with credit.

The accounts receivable team is responsible for managing the cash inflow to a business and ensuring that pending customer invoices are cleared in a timely manner. They manage operations such as invoice management, cash collections, and cash flow forecasting.

Here’s an example to understand this better.

Say, company A manufactures furniture in bulk for company B, a retail furniture store. Once the furniture is delivered, company A creates an invoice for company B for a total of $100,000 which needs to be paid 30 days from the date of delivering the shipment. Company A’s accounting team records this invoice under accounts receivable since they are eligible to “receive” a sum of $100,000 from company B.

What is an Accounts Receivable Helpdesk?

As a business grows, the accounts receivable process becomes more complex. There’s more customer requests coming in, more invoices to keep track of, and more cash collections to manage.

In such circumstances, an accounts receivable helpdesk can help streamline all communication on invoices and provide visibility into what’s happening across multiple invoices. For instance, if a customer reaches out to understand payment terms, you can ensure their query is answered in a timely manner

An accounts receivable helpdesk offers a centralized system to keep track of all incoming customer questions related to payment and billing. Each question/query is then routed to appropriate experts in the finance team who then work to resolve them.

Aside from this, an accounts receivable helpdesk can be used to schedule cash collection reminders and enable self-service options for customers in order to avoid late payments.

The platform can also automate several repetitive tasks including sending out payment reminders and assigning incoming tickets to the appropriate experts.

13 Best Accounts Receivable and Accounts Payable Software

10 Step Process to Implementing a Global Accounts Receivable Helpdesk Process for Your Business

Implementing an accounts receivable helpdesk can help you streamline your accounting system. However, there are certain best practices that you need to follow while implementing such a helpdesk for your business.

Here’s a detailed look at how you can seamlessly implement an accounts receivable helpdesk .

1. Evaluate your current accounts receivable workflow

For most businesses, the accounts receivable process typically involves the following steps:

- Onboard the customer

- Sell to the customer on credit

- Create a record of the sale

- Determine the time period for the payment to be made

- Generate an invoice for the sale

- Send out follow up emails or payment reminders to the customer

- Initiate a collection process

- Full or partial payment made by customer

- Process the payment

- Validate payment receipts against open invoices

- Mark payment status as ‘closed’ once total amount is received

By evaluating your current accounts receivable process, you can identify gaps or errors that need to be addressed. A thorough look at your accounts receivable workflow can also help you understand how exactly a helpdesk can increase the effectiveness of your accounting process.

For instance, if you’ve been using paper invoices for your transactions, an accounts receivable helpdesk may help you switch to e-invoicing. Not only does this improve the efficiency of the AR system and reduce the probability of errors, but also improves the efficiency of the accounts receivables system. Going paperless can also help in improving visibility into the communication on invoices.

2. Define your accounts receivable helpdesk goals

After evaluating your accounts receivable process, the next step is to clearly understand the goals you aim to achieve by investing in a helpdesk.

To start with, you could ask the following questions:

- Should the accounts receivable helpdesk offer multi-channel support?

- Do you require internal collaboration functionalities?

- How many inboxes would you need to answer customer queries? For instance, do you need multiple inboxes such as accountsreceivable@xyz.com, accountingsupport@xyz.com? Or would you prefer a single shared inbox like accounting@xyz.com to address all queries ?

- How would you categorize and route incoming tickets to different team members?

- Would you require extensive integrations and customizations?

- What kind of metrics would you want to track and what type of reports would you want to generate?

- Are self-service options important?

Addressing these questions can give you better insight into everything you would need from your accounts receivable helpdesk. It can also give you a fair idea of how much you will actually need to spend on implementing a helpdesk for your accounting processes.

How Countless Revamped its Customer Service with Efficient Email Management

3. Work out your accounts receivable helpdesk workflow

Once you’ve evaluated your objectives with an accounts receivable helpdesk, you will need to plan out your helpdesk workflow. Defining your helpdesk workflow is important to improve agent productivity and increase the efficiency of your accounts receivable process.

For instance, what sequence of steps would be activated when a customer raises a ticket? How would tickets be prioritized and how would incoming tickets be routed to agents? How can the status of a ticket be determined

4. Determine the number of users

After planning out the workflows, you’ll need to determine how many users will use the helpdesk. You will also need to understand the various user roles within the helpdesk and also figure out the different permissions and access requirements.

Some of the user roles are:

- Admin – Typically someone like the head of finance or the chief accountant who oversees different operations such as accounts, payroll, reporting, etc. They are in charge of global settings and can invite users and grant them access and other permissions.

- Agent – This user role is assigned to someone like an accounts receivable officer who is in charge of invoicing, billing, and following up with debtors. They do not have access to global settings but can manage tickets and access reports to analyze performance.

- Members – A member is usually someone like a bookkeeper who has limited access to the helpdesk. They can respond to tickets from customers.

Determining the number of users is a critical step in deciding the number of licenses that need to be purchased for your accounts receivable helpdesk.

Remember to choose a helpdesk solution that is easier to scale as your team grows later. A common problem with most helpdesks is that licenses can be quite expensive. This means that as you grow, agent licenses alone can cost you quite a lot.

For instance, with a helpdesk like Zendesk, you end up paying nearly 2x more for agent licenses annually as compared to Hiver. Not to mention the extra costs associated with essential support features such as automations, SLAs, internal collaboration, and customer feedback.

5. Integrate with critical third party applications

Accounting teams use different types of tools and software to streamline and automate their tasks. These include tools to handle different accounting operations such as bookkeeping, invoice management, compliance management, and expense reporting.

Your helpdesk tool needs to integrate with other essential applications so that your team does not have to spend time switching between multiple tabs to get things done. This improves the efficiency of your accounting processes and enables you to clear outstanding invoices faster.

A good example is how Hiver integrates with QuickBooks , an accounting software. This integration allows you to easily add, track, and manage all your invoices from the comfort of Gmail.

6. Define SLAs for issue resolution

SLAs or Service Level Agreements define certain standards for support. It sets a benchmark for performance metrics like first response time, average resolution time, etc. so that agents can meet customer expectations every single time.

In accounting, SLAs are crucial since delayed resolution of invoices or transaction-related queries can interfere with timely payments and ultimately affect cash flow.

Hiver allows you to easily set up SLAs for all incoming customer conversations. For instance, say every incoming query on billing needs to be responded to within two hours. Now, in case this doesn’t happen, you can configure an SLA violation condition such that whenever a query is not acted upon within two hours, relevant stakeholders are notified.

This way you can ensure that all conversations from customers or vendors are attended to on time.

7. Set up self-service options for customers

Your accounting team will likely be dealing with a lot of repetitive but straightforward queries on a daily basis. These queries can be related to payment terms, specific processes, or it can even be something as minor as reconfirming prices for an upcoming payment.

In such situations you can enable customers to resolve basic queries by themselves.

Self-service options such as help centers, FAQs, and knowledge bases are highly useful features that can help with instant query resolution.

A customer can simply search through a knowledge base whenever they need help and avoid having to rely on your accounting team every single time for help. This improves the customer experience and also reduces the workload of your accounting team and helps teams to focus on more important tasks.

For instance, you can use Hiver’s Knowledge Base to build a centralized repository of information that includes answers to FAQs, how-to guides, and instructions. Your customers and agents can refer to these articles any time they need. In case customers are unable to find what they’re looking for, there is an option to raise a ticket from inside the knowledge base.

8. Define key performance metrics

The very purpose of setting up an accounts receivable helpdesk process is to elevate your accounting processes.

This is why it is important to define certain performance metrics and KPIs to understand the efficiency levels of your accounting team and see where they need help.

Some of the metrics that you need to track would be:

- First response time – How long it takes for your support team to first respond to a new ticket

- Average resolution time – How much time it takes to resolve a customer ticket on average

- CSAT – How satisfied is a customer with the support they have received

- Ticket backlog – How many tickets are still pending resolution

By defining key metrics and tracking them, you get a better idea of what needs to be improved for a smoother workflow.

18 Key Customer Service Metrics and How to Use Them

9. Configure accounts receivable helpdesk security settings

Your accounting and finance teams handle quite a lot of sensitive information such as bank account numbers, customer data, invoices, and other financial documents.

When implementing a helpdesk, security and privacy is of the utmost importance since any discrepancy or errors with such sensitive information can have serious consequences.

This is why it is highly recommended that you define compliance regulations right from the start when setting up your accounts receivable helpdesk. Regular check-ins and updates are also a great way to ensure that all security requirements are in place.

A helpdesk like Hiver has a robust security and privacy policy. The platform is ISO27001, SOC2 Type II, GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act) compliant.

Aside from this, Hiver also follows other security protocols. These include:

- Internal security policy – Two factor authentication and strong password policies to ensure that security practices are being adhered to within the team.

- Security audits – Regular 3rd party audits to check for any vulnerabilities or discrepancies.

- Incident response policy – A set of strict guidelines on how to handle and respond to security related events.

- Vulnerability Disclosure Program – A protocol where security researchers are encouraged to report any anomalies.

- Email storage – Emails are not stored on Hiver’s servers except temporarily for an hour while they are being synced between two Gmail accounts. Emails are encrypted during this time and then cleaned up automatically.

This way you can be sure that all your sensitive information is handled with utmost security and caution.

Hiver : A Secure Helpdesk that Does Not Store Your Emails

10. Deploy the helpdesk, test, and optimize

Now that you’ve ticked off most of the essential steps while setting up your accounts receivable helpdesk, the only thing remaining is to actually deploy the helpdesk and make sure everything is running smoothly.

A good way is to test out how the automated workflows are performing. You need to see if you’re able to track metrics that matter to you.

Aside from this you will also need to check if the roles and permissions are assigned in the right manner and that not everyone has access to sensitive data.

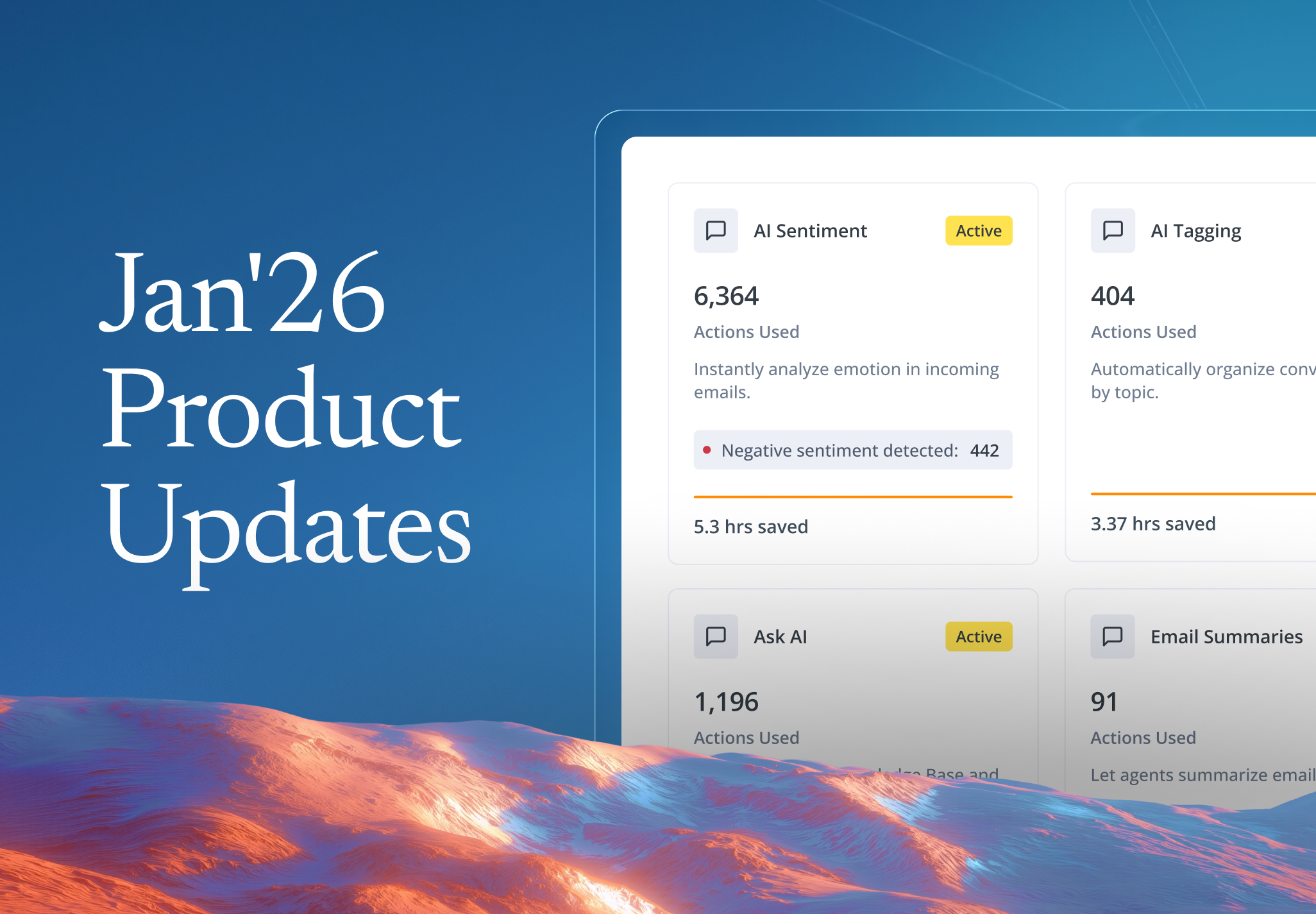

Hiver, A Multichannel Helpdesk to Streamline Your Finance Operations

Built specifically for teams on Google Workspace, Hiver

enables accounting teams to run their finance operations from right inside Gmail. It can help your business accelerate cash collections, manage vendor emails, and process incoming customer requests with ease.

Here’s how Hiver can help your accounts receivables team:

Never miss out on important customer emails: Say a customer emails you with a payment related query. It is important to ensure that this email is assigned to the right agent and acted upon in a timely fashion to avoid missed payments.

Hiver allows you to set up alerts so that any time an email is missed or not acted on within a specific time, relevant stakeholders are notified.

Smooth internal collaboration: Hiver’s Collaborators feature enables cross-team collaboration with ease. Say your accounting team receives an email from a customer for which they need the help of the legal team. All they have to do is simply @mention the relevant person from the legal team alongside the customer query to collect their inputs.

Seamless approval process: Processing invoices and payments requires a number of approvals from stakeholders. With Hiver, you can set up multistep approval workflows with different approvers across departments.

Automate repetitive and mundane tasks: Say you want to categorize all upcoming customer payments under a single tag. Simply set up the automation in such a way that all queries with the term ‘credit’ can automatically be tagged as ‘Receivables’

If you want to explore more and understand how Hiver can help you manage your finance operations, simply schedule a demo with our experts today.

Skip to content

Skip to content