Invoicing is a crucial aspect of any business operation, and it is currently undergoing significant changes. With a move toward digitization and automation, the process of managing invoices is becoming more efficient. Businesses are increasingly seeking ways to streamline operations, reduce costs, and enhance efficiency. As such, paperless invoicing has emerged as a crucial step in this direction—promising significant improvements in managing invoices.

Before we tread any further, let’s take a quick look at the current invoicing practices:

- Nearly 48% of businesses manage up to 500 invoices each month, with 66% spending over five days monthly on processing.

- Only 52% of invoices are received electronically, with the rest still paper-based

- 37% of businesses also use paper invoice receipts

From cutting down on human error to decreasing processing costs, paperless invoicing offers many advantages. In this guide, we’ll discuss why adopting a paperless invoicing system is beneficial and explore the future trends and technologies driving this shift.

Table of Contents

- The transition toward paperless invoicing

- Going paperless: 5 key benefits of moving to paperless invoicing

- Technological innovations are driving paperless invoicing

- Challenges in adopting paperless invoicing

- Future trends in paperless invoicing

- Supercharge your financial operations with paperless invoicing

The transition toward paperless invoicing

The digital transformation of invoicing and statutory reporting is not just a luxury—it’s essential for organizations seeking efficiency, precision, and compliance. Invoice approvals, typically requiring 2–3 people, are the most commonly automated task in accounts payable. This automation streamlines the process, reducing delays and errors.

Many businesses have already started to automate their invoicing systems. Among them, 41% have automated invoice approvals, and 26% aim to achieve full automation by 2024. Additionally, companies that implement paperless invoicing can expect to see faster processing times, reduced costs, and improved accuracy. By reducing their reliance on paper, businesses can also enhance their environmental sustainability efforts.

Going paperless: 5 key benefits of moving to paperless invoicing

CFOs who automate manual accounting tasks, including paper invoicing, can free up to 60% of their team’s time.

While there are many benefits to paperless invoicing, we will look at the top five.

1. Cost reduction

Paperless invoicing significantly reduces the costs associated with paper, printing, postage, and storage. According to a 2023 study by Ardent Partners, businesses that adopted paperless invoicing reduced their invoicing costs by up to 80%. These savings can be redirected to other critical areas of the business, thereby enhancing overall financial performance.

Take the case of Boston Properties. The real estate company used to spend $0.55 per paper mail to 2,200 tenants. By adopting paperless invoicing with Versapay, they save at least $1,210 per month—totaling $14,520 per year—plus the labor costs associated with preparing those mailings.

2. Enhanced accuracy and reduced errors

Manual data entry in traditional invoicing is prone to human errors, which can lead to costly discrepancies. Paperless invoicing systems utilize automated data capture and validation techniques, ensuring higher accuracy. This accuracy minimizes errors and accelerates the invoice approval process, propelling businesses toward faster payment cycles.

3. Improved cash flow management

Timely and accurate invoicing directly impacts cash flow management. Paperless invoicing enables quicker invoice processing, which in turn facilitates faster payments. This improved cash flow management allows businesses to better predict and manage their financial health, ensuring sufficient liquidity for operations and growth.

4. Environmental sustainability

The environmental impact of traditional invoicing is considerable, with significant amounts of paper and ink used annually. By transitioning to paperless invoicing, businesses contribute to environmental sustainability. This shift reduces paper waste and minimizes the carbon footprint associated with physical document transportation and storage.

5. Speeding up invoice processing

Switching to paperless invoicing can significantly speed up the invoice processing time. The average time it took a mid-market enterprise to process an invoice was 12.9 days. With digital invoicing, this time can be drastically reduced.

Automated systems allow invoices to be generated, sent, and approved much faster than traditional paper-based methods. This acceleration means quicker payments, improved cash flow, and more efficient financial operations overall.

Technological innovations are driving paperless invoicing

The technological landscape is continuously evolving, and several innovations are shaping the future of paperless invoicing. These advancements are not just about going digital but about leveraging technology to optimize and enhance invoicing processes.

1. Cloud-based solutions

Cloud-based invoicing platforms offer real-time access to invoicing data from anywhere, at any time. These solutions facilitate frictionless collaboration between departments and with external stakeholders, such as suppliers and clients. The security features of cloud platforms also ensure that sensitive financial information is protected against unauthorized access.

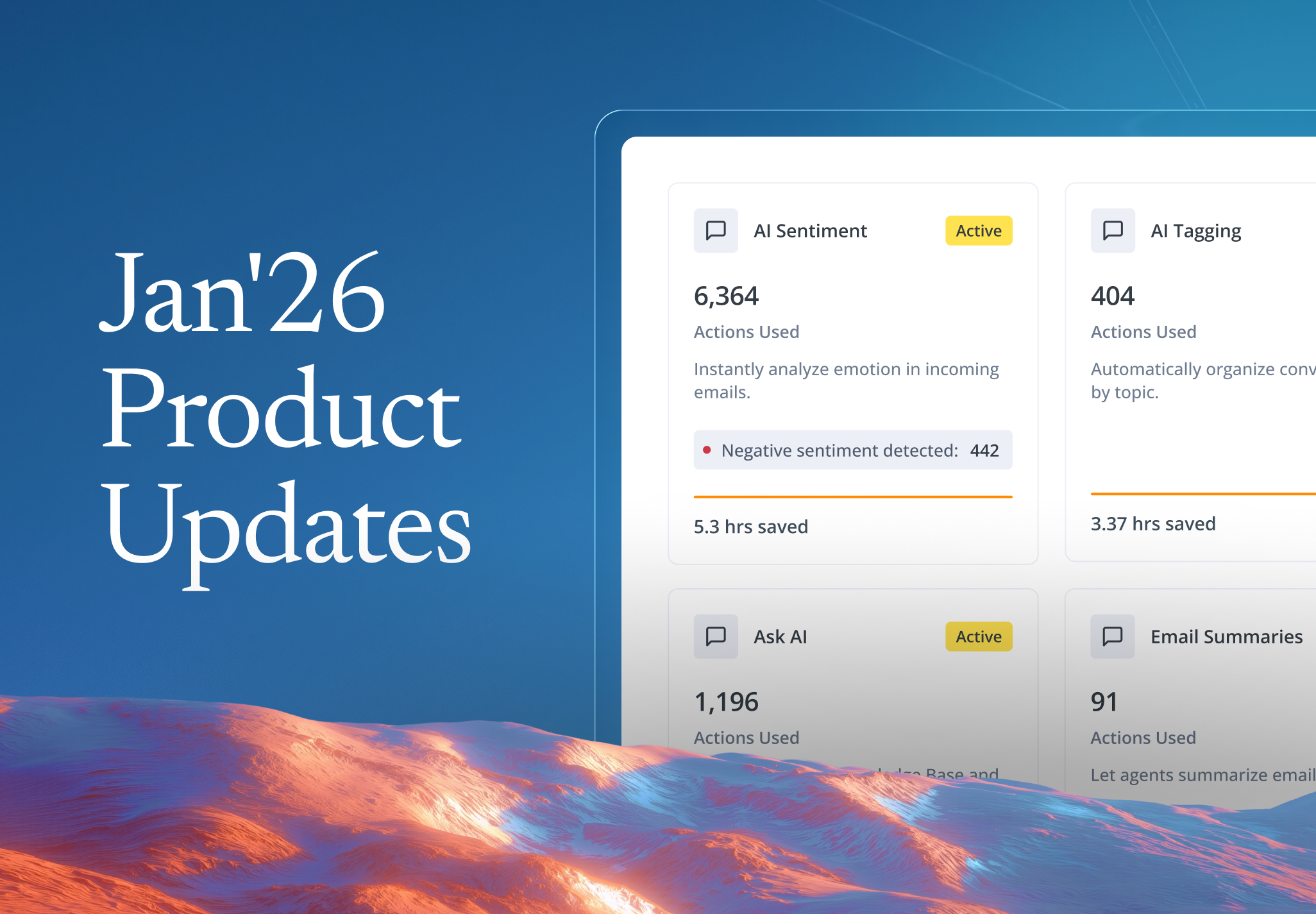

2. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing paperless invoicing by automating complex processes and providing predictive analytics. These technologies can analyze large volumes of invoicing data to identify patterns, forecast trends, and detect anomalies. For instance, AI-powered systems can automatically flag invoices that deviate from normal patterns, thereby preventing fraud and errors.

3. Blockchain technology

Blockchain technology offers unparalleled security and transparency in invoicing processes. By creating immutable records of all transactions, blockchain ensures that every invoice is verifiable and tamper-proof, enhancing overall blockchain security. This technology is particularly beneficial for industries where compliance and auditability are critical.

4. Electronic Data Interchange (EDI)

EDI facilitates the electronic exchange of invoices and other business documents between companies. This standardized format ensures that data is transferred accurately and quickly, reducing the need for manual intervention. EDI integration with existing ERP systems further enhances the efficiency of invoicing processes.

Challenges in adopting paperless invoicing

While the benefits of paperless invoicing are clear, businesses may encounter several challenges during the transition. Effectively managing and overcoming these challenges is essential for successful implementation.

- Resistance to change

Change management is a significant challenge when adopting new technologies. Employees accustomed to traditional methods may resist transitioning to paperless systems. Effective change management strategies, including training and continuous support, are essential to overcome this resistance.

- Integration with existing systems

Integrating paperless invoicing solutions with existing ERP and accounting systems can be complex. It requires careful planning and execution to ensure smooth data flow and interoperability. Businesses must work with experienced technology partners to navigate these integration challenges.

- Data security concerns

Digital invoicing involves handling sensitive financial data, making data security a top priority. Businesses must implement robust cybersecurity measures to protect against data breaches and cyber threats. This involves using encryption, implementing access controls, and conducting regular security audits.

Future trends in paperless invoicing

The landscape of paperless invoicing is rapidly evolving, driven by several emerging trends that are set to shape its future:

- Predictive analytics: Future invoicing systems will leverage predictive analytics to forecast cash flow, anticipate payment delays, and optimize invoicing strategies based on historical data and market trends.

- AI-driven automation: AI will continue to play a pivotal role in paperless invoicing, with more advanced automation capabilities. AI-driven systems will handle even more complex tasks, such as contract analysis and compliance checks, further reducing the need for manual intervention.

- Internet of Things (IoT) integration: IoT will play a role in paperless invoicing by enabling devices to automatically generate and process invoices based on usage data—leading to more accurate and timely billing.

- Enhanced collaboration tools: Collaboration tools like Hiver, integrated into paperless invoicing platforms, will facilitate better communication and coordination among team members and external stakeholders. These tools will streamline the workflow, ensuring that invoices are processed efficiently and accurately.

Supercharge your financial operations with paperless invoicing

By embracing digitization and leveraging innovative technologies in invoicing, businesses can unlock numerous benefits, including increased accuracy, cost savings, and improved cash flow management.

As the landscape of paperless invoicing continues to evolve, staying ahead of the trends will ensure that your business remains competitive and efficient. Embrace the digital transformation, unleash the potential of modern invoicing solutions, and elevate your financial operations to new heights.

Skip to content

Skip to content